Deep Dive - Ferrari

The unmatched true luxury company of the automotive industry?

Welcome Readers!

Ever heard of Ferrari? I’m sure you have. This company may be one of the sexiest true luxury companies in the world, and one of the best true luxury companies to add to your investable universe. If you haven’t heard of this company, let’s dive deep into it in this analysis.

(Disclosure: All of this information is at the time of this writing. I am currently not long $RACE)

Table of Contents

History of the business

Economic Moat

Business Model

Financials

Opportunities

Risks

Valuation

1) History of Ferrari

“Born of the spirit of racing, Ferrari epitomizes the power of a lifelong passion and the beauty of limitless human achievement, creating timeless icons for a changing world”

— Ferrari’s About Us

The story of Ferrari all started from the quiet streets of Modena, Italy, and is one that speaks to the essence of true luxury—not just in terms of wealth or status but in the meticulous craftsmanship, relentless pursuit of excellence, and the passion that courses through every curve of the car. Ferrari is not merely a brand. It is a movement, a way of life, and an embodiment of the human spirit’s desire to push beyond limits.

It all began in 1939 when Enzo Ferrari, a man driven by sheer passion for motorsport, started Auto Avio Costruzioni after leaving Alfa Romeo, a luxury Italian carmaker today. At that point, Ferrari was not a household name, but Enzo’s vision was clear: to build the fastest and most beautiful cars in the world.

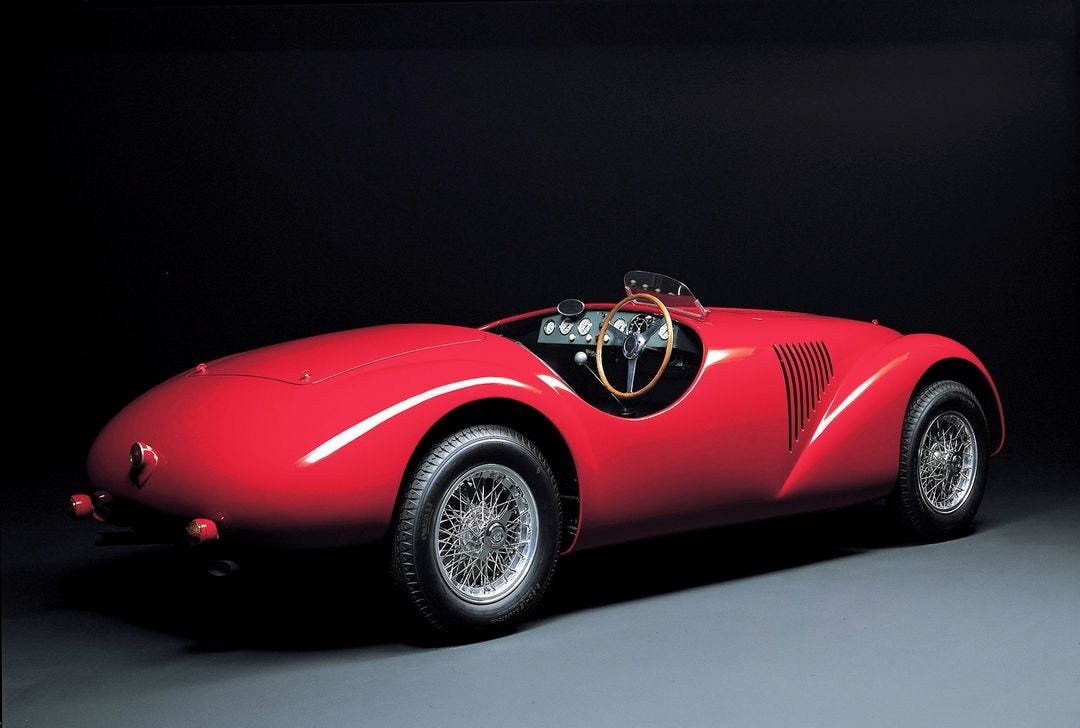

The first Ferrari-badged car, the Ferrari 125 S, rolled out in 1947, and from there, the brand became synonymous with motorsport dominance. Ferrari’s entrance into Formula 1 in 1950 was nothing short of legendary, a reputation it continues to hold today. Winning on the track meant trophies and that it was proof of Ferrari’s uncompromising commitment to quality and innovation. Each car they crafted was a reflection of that same philosophy.

Source: Ferrari

Luxury, in the truest sense, is not about mass production or catering to trends. Ferrari understands this. Their cars are still built with an artisan's touch, with each piece painstakingly designed, developed, and assembled. In this way, Ferrari has maintained its exclusivity. You’re not just buying a car—you’re becoming part of a heritage, a legacy of craftsmanship and performance that few others can claim in the world.

Ferrari’s brand today has transcended the auto industry to become the global symbol of prestige and passion. A timeless appeal, where each model represents more than just horsepower—it tells a story of innovation, of overcoming challenges, of pushing boundaries. That is why Ferrari commands such loyalty and respect, both from car enthusiasts and the market.

Today, those who purchase a Ferrari car recognize the narrative of human achievement, emotion, and a commitment to excellence that resonates on a visceral level. This is a brand that sells dreams as much as it sells cars, and in today’s world, where luxury is often commoditized, Ferrari remains a testament to what true luxury really means: heritage, emotion, and a relentless pursuit of perfection.

Here’s an excerpt from Ferrari’s About Me page under ‘Areas of Business’

“The Prancing Horse symbolizes exclusivity, performance and quality all over the world.

Our prestige is built upon decades of sporting success and the inimitable style of our cars, which are unique in their innovation, technology and driving pleasure.

We craft exclusive, authentic and memorable experiences for our clients in everything we do.”

The Prancing Horse symbol is a symbol of aspiration, of being part of something greater than oneself. Today, that logo is as legendary as the cars it graces, instantly recognized as a hallmark of performance and exclusivity. In a sense, Ferrari customers are not only buying the product itself but the dream associated with it. Wrapped in carbon fiber and leather, their product is the epitome of an achievement, a beautifully executed delivery mechanism that allows one to taste the rarest of luxuries: feeling like you're a part of something extraordinary.

Ferrari sells two main things:

Exclusivity.

True Luxury.

All in the shape of a car.

2) Moat — The Ferrari Brand

Let’s focus on the two aspects that come with purchasing a Ferrari car first of all.

2.1 Exclusivity

What is Exclusivity, first of all?

Exclusivity is the sense of belonging to a rare, elite group.

In this case, Ferrari intentionally excludes a large portion of potential customers to be truly perceived as a true luxury company, and perhaps the luxury status of the automotive industry.

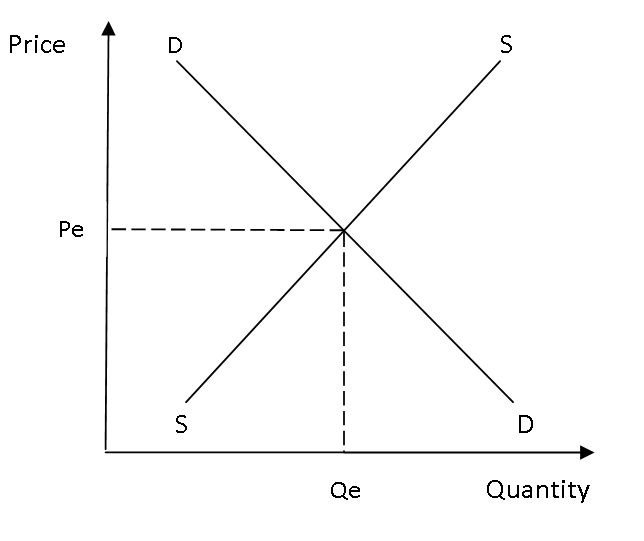

Let’s go back to simple Economics first. One of the first and most fundamental concepts we learn in Economics is the law of supply and demand:

There is a relationship that dictates a market:

When demand is high and supply is low, prices naturally rise.

Conversely, when demand falls and supply increases, prices fall.

Price moves to find equilibrium—where everything is sold, until both parties (consumers and producers) are satisfied. Higher prices incentivize for more supply, and more supply brings down the price, creating a self-regulating cycle.

However, this classic supply and demand curve only works when all elements—supply, demand, and price—are free to fluctuate without interference. When one of these is artificially controlled (which is what Ferrari does), the balance shifts.

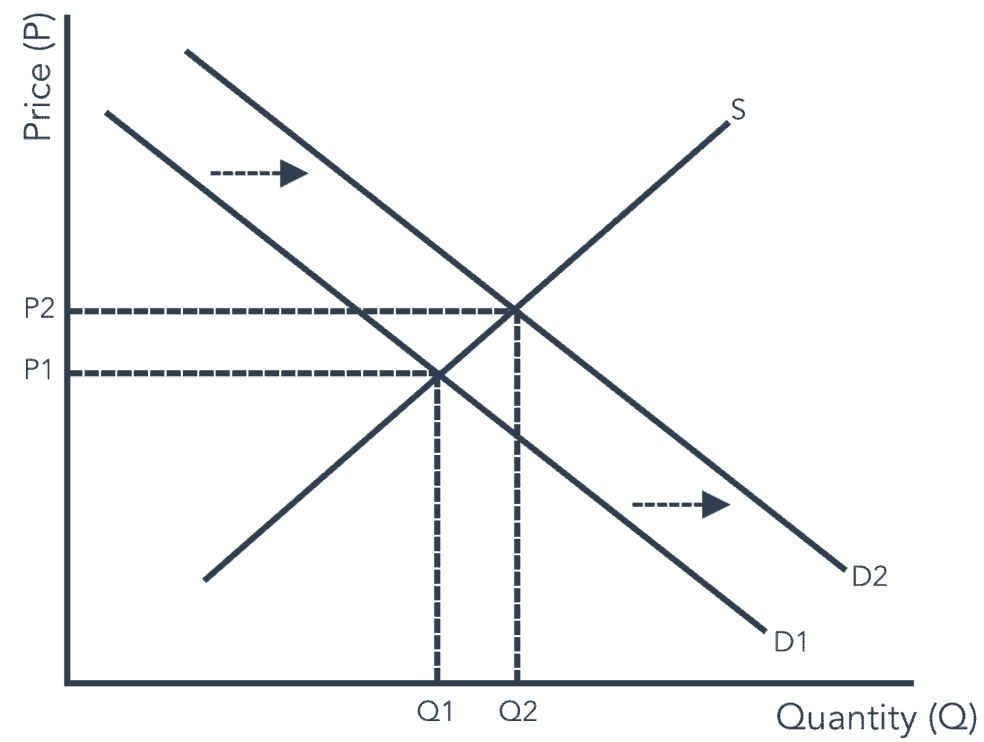

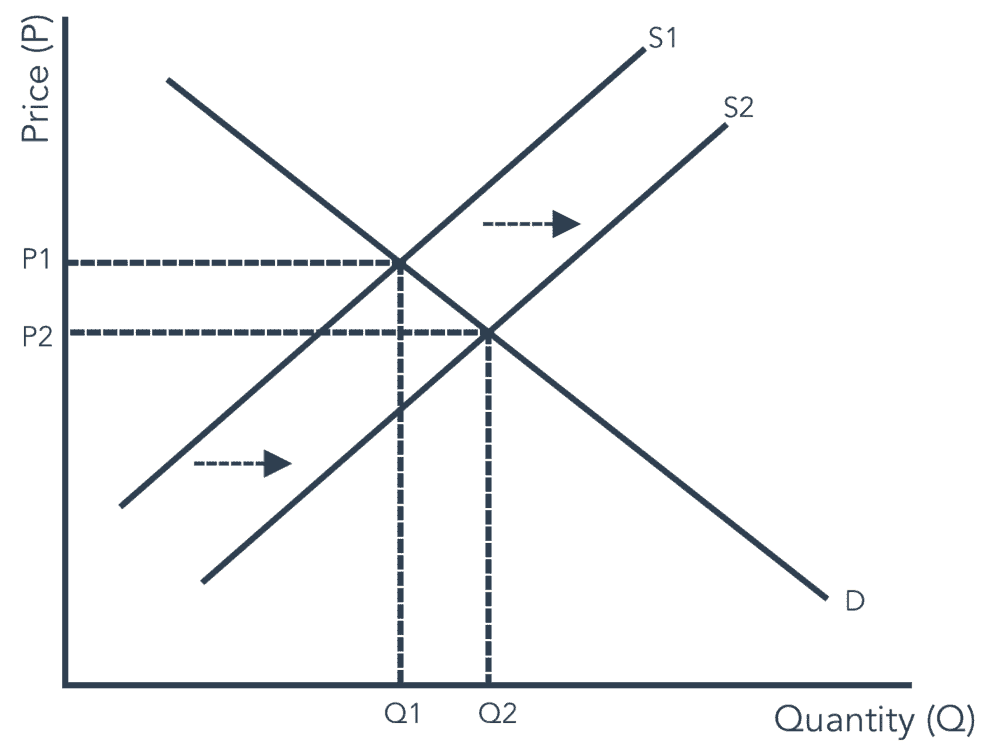

Ferrari manipulates the economic principle of demand and supply by setting a production cap to limit supply and push prices higher, creating a controlled scarcity. By producing only a limited number of vehicles per year, they keep their prices soaring while sustaining high demand.

Ferrari artificially creates this scarcity to drive exclusivity, and their decision to limit production is not by necessity, of course. Ferrari has the resources to manufacture tens of thousands of cars, easily achieving economies of scale. Yet, that is not the ‘Ferrari way’. Limiting models is never about capability—it is about preserving the allure of rarity.

For example, Ferrari offers two Competizione models (supercars) as “two interpretations of Ferrari's racing soul.” However, Ferrari produced only 999 models of the 812 Competiziones and 599 of the Aperta or “A” variants available!

(To nobody’s surprise, both of these models are sold out.)

Source: The Collectors Circle

If one day, Ferrari decided to produce 100,000 of these models (therefore injecting 100,000 into supply), not only would the price drop (again think back to economic theory), but they would lose the very essence that makes them irresistible. What keeps people willing to spend hundreds of thousands is not just the car itself but the feeling that they’re buying into something few others can only have. In a world where luxury is often diluted, Ferrari fiercely protects what makes them special. Their commitment to exclusivity allows them to defy the traditional laws of supply and demand and continue commanding extraordinary prices.

In the case of Ferrari, they do not and will not chase mass-market appeal or attempt to meet all potential demand. Instead, they always create a controlled scarcity, heightening desire and reinforcing the brand’s prestige.

"Ferrari will always deliver one car less than the market demand. This is well summarized what Enzo Ferrari, our founder said, and I can assure you that this will never change."

— Benedetto Vigna, CEO of Ferrari

Since its inception in 1947, Ferrari has produced fewer than 250,000 cars—astonishingly, this is less than what Porsche rolls out in just one year! This scarcity is no accident; it is the cornerstone of Ferrari’s brand strategy. By keeping production limited, Ferrari ensures its vehicles remain exclusive and coveted, reinforcing the perception of their luxury. The brand isn’t restrained by capacity, however. In fact, Ferrari could easily double its production numbers. However, the brand is wisely choosing not to. This deliberate control over supply preserves its allure, making each Ferrari not just a car but a statement of uniqueness and prestige.

The defiance of conventional economic principles where scarcity is not a challenge but an advantage enables Ferrari to charge premium prices and still have buyers waiting eagerly, sometimes for many years, for the chance to own a piece of that luxury.

You may ask, how does Ferrari grow then if it has limitations on volume growth? Luxury brands have long faced the challenge of balancing growth with exclusivity, and they’ve employed strategies to manage this delicate equilibrium.

Ferrari uses an approach by managing volume growth not by flooding the market with more of the same model but by introducing new models and series while limiting production numbers for each. Each series has its production capped, so even as Ferrari expands its lineup, each model remains exclusive. This tactic allows the company to grow without diluting the prestige associated with owning a Ferrari.

This strategy that Ferrari uses just show a trend whereby luxury brands have learned to navigate the paradox of growth versus exclusivity by reinforcing brand loyalty through limited releases, preserving the rarity and desirability of their products. In doing so, they maintain their appeal to high-net-worth individuals while expanding their market presence carefully and strategically.

At the end of the day, as long as Ferrari’s supply is less than the market demand, the brand will retain exclusivity. A luxury brand needs far more admirers and dreamers than actual buyers to maintain its allure. The quality of that exclusivity depends on strategy, culture, and even the tiniest of things that Ferrari does to maintain brand perception.

What does the exclusivity mean exactly? More desirability, as a result, for each Ferrari car and of course, for the overall brand itself.

2.2 True Luxury

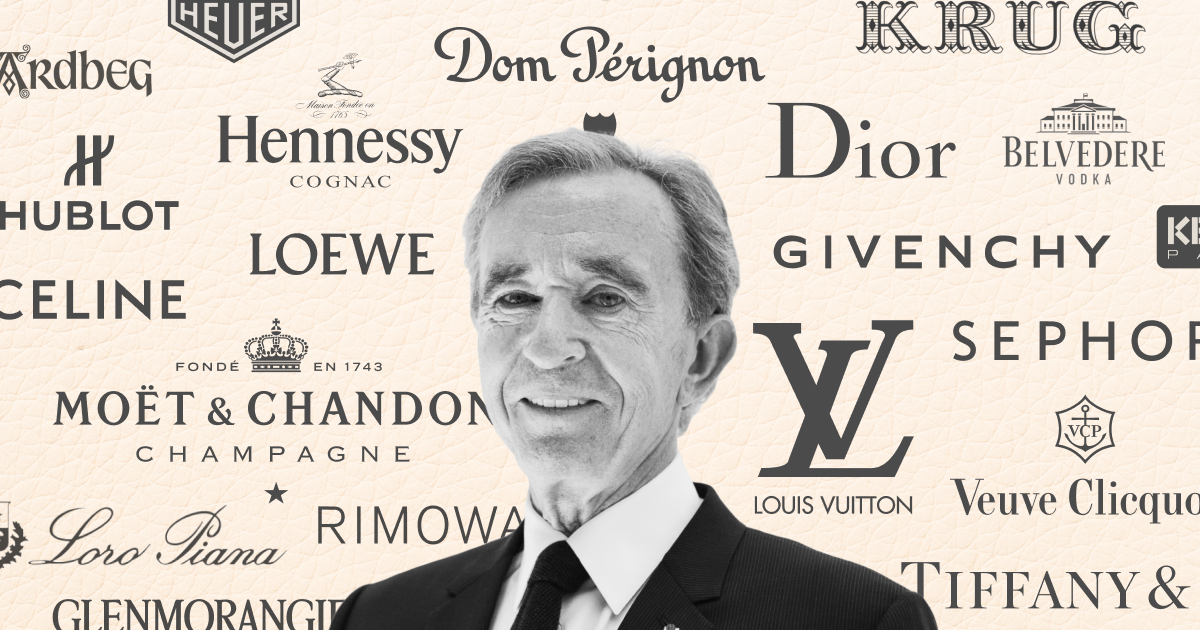

Source: The Brand Hopper

For centuries, the wealthy have sought to acquire goods that are not just expensive but rare, unique, and imbued with a sense of craftsmanship that sets them apart.

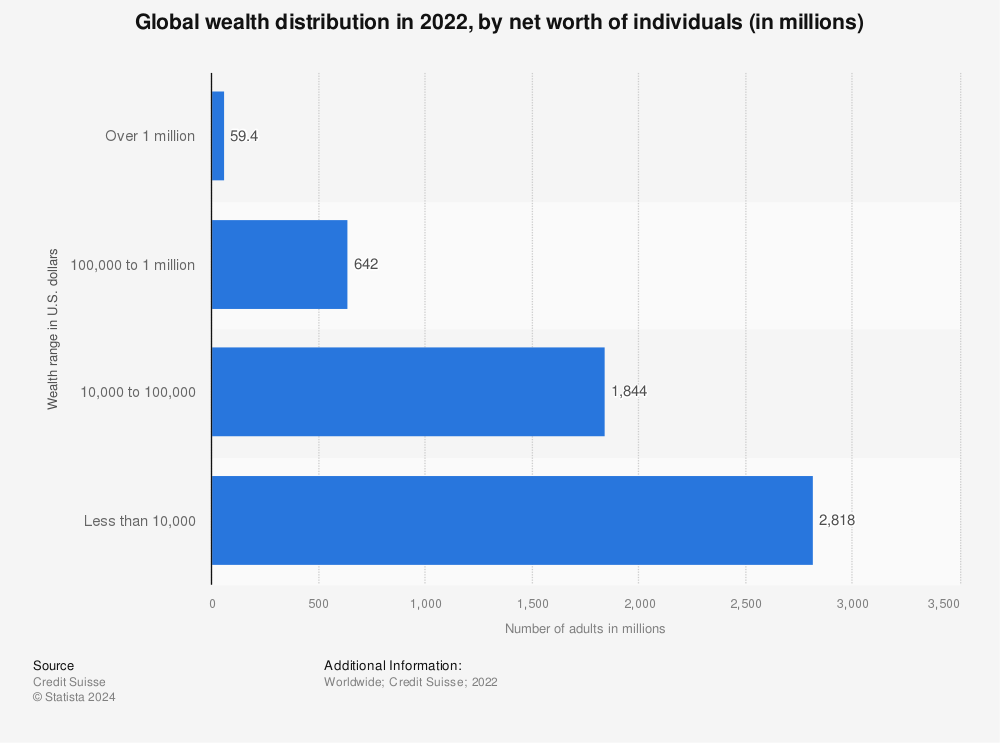

According to Credit Suisse, there are approximately 60 million individuals with assets worth over $1 million U.S. dollars:

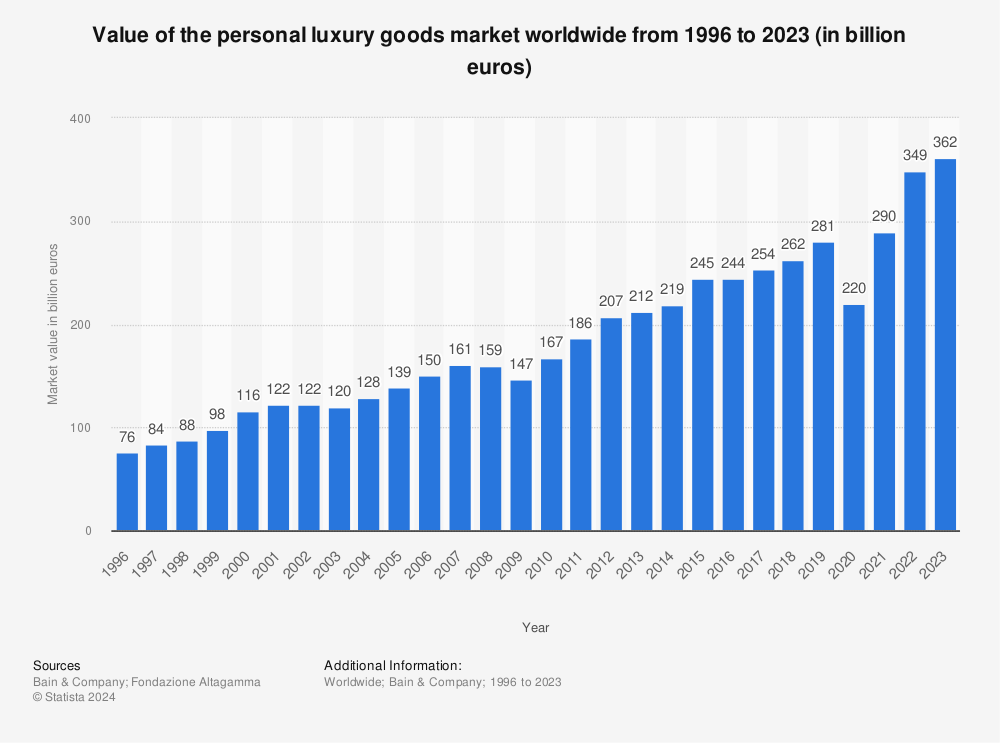

This number is set to rise substantially as more and more of the world is becoming more developed, with demand for luxury goods increasing significantly as more and more people become obsessed over status and looks:

What are luxury goods?

Luxury goods are high-end products typically associated with superior quality, craftsmanship, and exclusivity. These items are not just expensive. They also carry a reputation of prestige and status. Luxury goods often emphasize aesthetic appeal and brand heritage, and cater to consumers who seek both the tangible product and the intangible value of owning something elite. Well-known examples include your Rimowa luggage and Gucci apparel. These brands have become symbols of wealth and taste, often crafted with premium materials and meticulous attention to detail.

Humans have sought social status for more than 5,000 years, dating back to Ancient Egypt, where luxury and status were already intertwined. In today’s world, with the rise of social media, it is absolutely clear that the influence of social status on our lives has only grown, not diminished.

But what are true luxury goods?

But if we look deeper, true luxury isn’t defined simply by price or exclusivity. True luxury is about creating something irreplaceable, something that resonates on a deeper level, an experience that transcends the tangible. A true luxury company goes beyond producing products—they deliver an emotional journey that reflects the brand’s legacy and prestige. True luxury brands build timeless icons or “everlasting SKUs” that are like works of art that never go out of style and whose value increases over time. With time, fashion fades away, and products need to be heavily discounted. In contrast, the essence of true luxury brand management is time. True luxury takes time, and true luxury sells time. There is no hurry, because the products are here to stay, and the price will remain. True luxury would never offer discounts or rebates because its brand products simply does not go out of fashion.

This true luxury status is what separates Hermès, Rolex, and Ferrari (and perhaps a few more, in my opinion) from many others claiming luxury status but that actually operate under a fashion business model where outlets are the cost of doing business.

Many have tried to disrupt true luxury brands by offering high-quality products at high prices, but have always failed. This is because luxury is not a replacement for saying high-priced products (luxury is, of course, highly priced) but is a statement for trust and exclusivity. In addition to this, a company cannot suddenly ascend to the status of true luxury in a matter of 5-10 years, maybe even decades too. It takes layers and layers of generational building to construct a luxury brand like Ferrari.

Moving back to Ferrari, they possess all these traits of a true luxury good because:

A luxury good often places a greater emphasis on aesthetics than practicality (arguably what makes a luxury good stand out). Ferrari is not only flashy (with it’s bright red!) but every curve, every detail is meticulously designed to evoke emotion, much like a work of art. This is evident from the hand-stitched leather interiors to the flawless aerodynamic lines.

Extremely expensive. Each unit starts at around $200,000 to $400,000 (depending on the model). The high price is something synonymous that each true luxury brand has in common.

Ferrari has long waiting lists and times for each prospective buyer, ranging for 2 years to perhaps even 4-5 years depending on customization and model (this is also common with Hermes Birkin Bags and Rolex Submariners). They could make more, but it would offend existing Ferrari clients.

(This list is not exhaustive, of course.)

True luxury surpasses the grandeur of typical luxury by offering something far deeper: a unique sense of authenticity and an enduring calm. At its core, true luxury is defined by rarity and the emotions it stirs in those who experience it. The process of acquiring a Ferrari reflects this perfectly.

Expanding on the long waiting times for customers, with only a few hundred of these special models produced, it is no wonder they are coveted by collectors and displayed in museums. The anticipation alone builds a unique connection, and when the day finally arrives, the emotion of receiving a Ferrari (especially ones priced at $900,000!) becomes unforgettable. That first drive, after years of waiting, captures the essence of true luxury, and it is simply this emotional experience that Ferrari ultimately delivers to the end user.

The longer waiting times for customers actually work in favor for the company, not the opposite.

“Waiting is part of the experience.”

— Benedetto Vigna, CEO of Ferrari

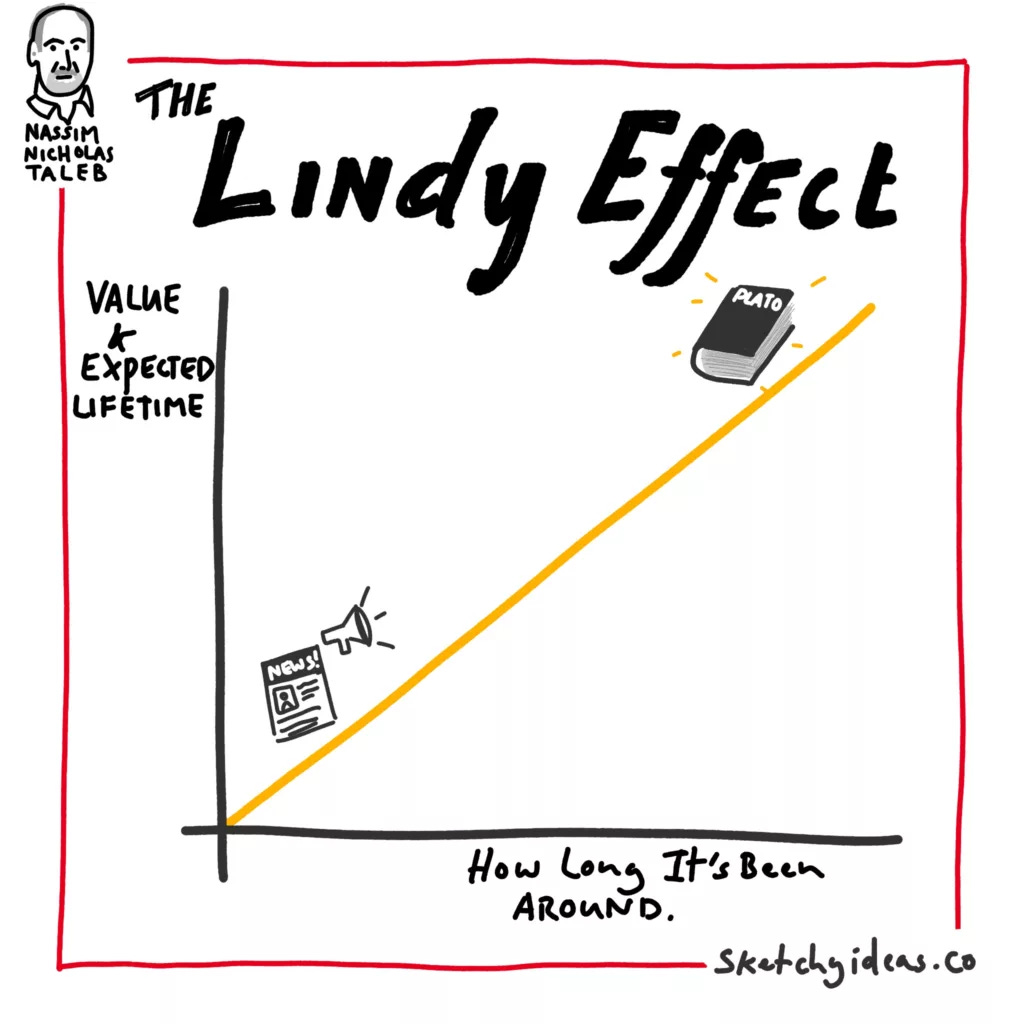

2.3) Lindy Effect

I wanted to talk a bit about the Lindy Effect. What is the Lindy Effect?

The Lindy Effect states that the longer a non-perishable item has been around, the longer it's likely to continue to exist. It's based on the idea that things that have "stood the test of time" are more reliable.

Corporate history often suggests that companies inevitably succumb to the pressures of capitalism. Over time, their outsized returns fall victim to the forces of competition, and they revert to the mean (back to the cost of capital)—or in extreme cases, fade out entirely.

Capitalism exerts a constant gravitational pull on high returns. When a company enjoys exceptional returns on its investments for an extended period, new entrants without strong competitive advantages will inevitably try to grab a piece of the market share. With more players in the mix, the pie starts to get divided among them, which leads to smaller slices for each competitor, ultimately lowering the returns for everyone involved in the industry.

Yet, a select group of companies has managed to defy this gravitational force. These are the businesses that have built formidable competitive advantages, shielding themselves from disruption. In their case, the usual dynamics of capitalism are delayed or even circumvented entirely, as these advantages create barriers that make it nearly impossible for competitors to chip away at their dominance. This is what Warren Buffett defines as the economic moat of a company.

Companies with very strong and enduring moats can sometimes perpetuate this into the future where these moats can strengthen as time goes on, which is where the Lindy Effect comes in.

“For the non-perishable, every additional day may imply a longer life expectancy.” — Nassim Nicholas Taleb

According to the Lindy Effect, a company that has been around for 100 years is expected to live at least an additional 100 years into the future. The effect is actually quite similar to the ‘winner-takes-all’ phenomenon where a company that has dominated for decades will likely continue to dominate.

The longer something has existed and endured through unpredictable shocks or extreme events, the more likely it is to survive future ones. The survival against volatility proves its resilience. In a world where the future is always uncertain, companies that not only withstand chaos but potentially benefit from it—those that are ‘antifragile’—tend to have a higher life expectancy. What makes this longevity credible is their track record of overcoming past disruptions. Essentially, the best way to predict their future survival is by looking at how they've thrived amid unpredictability in the past. This is why history isn't just a reference point but also a powerful tool for understanding the staying power of anything, be it a company, a tradition, or an idea.

The longevity signals not just survival but deep-rooted trust, quality, and a proven track record in their respective industries.

Applying this to Ferrari, the intelligent investor would recognize that Ferrari exemplifies Lindy characteristics, having endured a wide array of historical and economic challenges. Throughout the last century, Ferrari has not only survived, but thrived through:

World War I

World War II

Post-War Economic Recessions (especially in Italy after WWII!)

The Dot-Com Bubble

The Financial Crisis of 2008

The COVID-19 Pandemic

And the list goes on, on and on. The brand’s ability to weather these storms highlights its resilience, built on strong competitive advantages, an iconic legacy, and a loyal customer base—allowing Ferrari to stand firm against the forces of capitalism that would otherwise erode its market position. Despite many Black Swan events, Ferrari has proved to be resilient and has grown to a business worth $80 billion (as of this time of writing).

3) Business Model

Ferrari is, you guessed it, a car company. The company is responsible for designing, engineering and producing the world's most recognizable sports cars as of today. They sell luxury cars to wealthy consumers, making it a lot less cyclical than the average car company because the wealthy do not go through recessions or downturns, and are definitely willing to pay up for a classy car.

Ferrari’s overall revenue is primarily driven by Car Sales (making up 85%). This includes selling luxury sports cars like the Ferrari GTB or the limited editions which are higher-margin that cater to collectors, for example.

The rest of revenue is from other categories such as lifestyle activities & products, including theme parks in Europe (soon expanding to many other regions around the world), brand merchandise like apparel and accessories with the Ferrari branding on it, after-sales services for servicing, maintaining, and repairing Ferrari vehicles, and sponsorship deals from Formula 1 (F1).

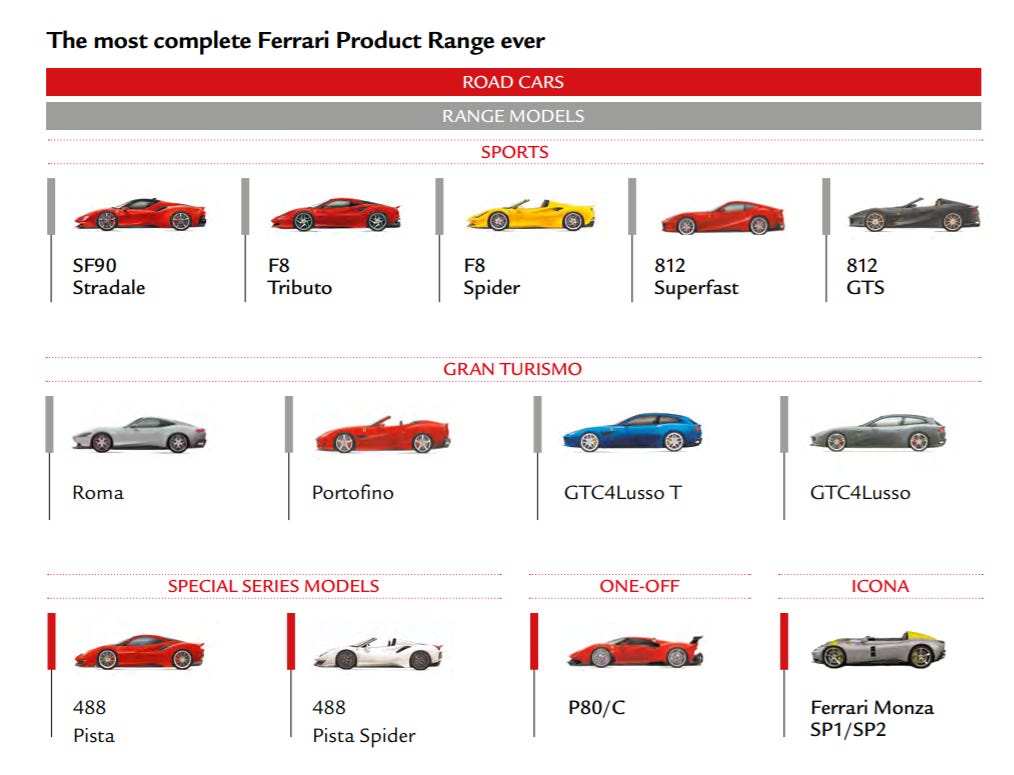

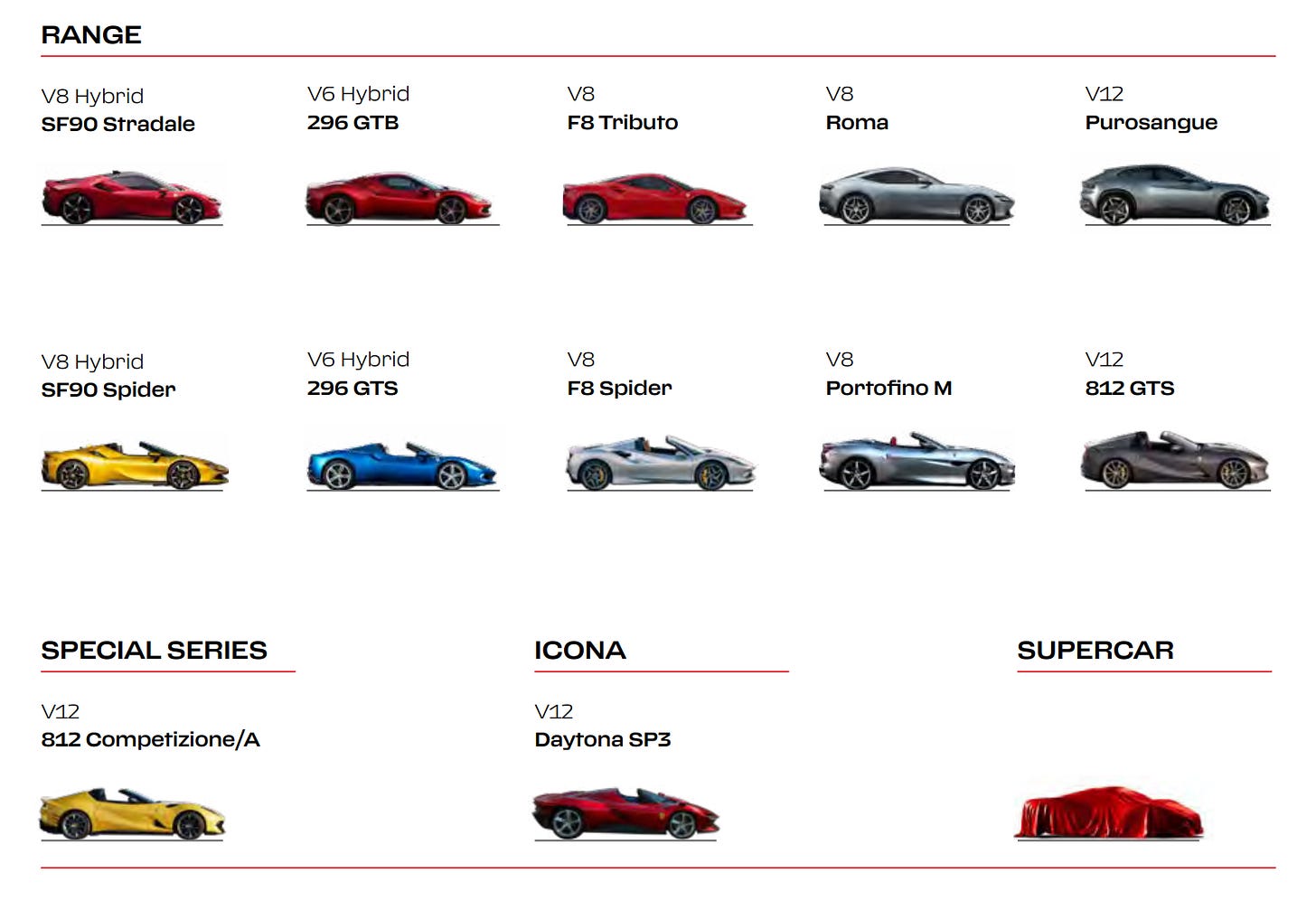

Ferrari currently offers 4 different car categories: Range (making up around 93% of production), Special Series, Icona, and Supercar:

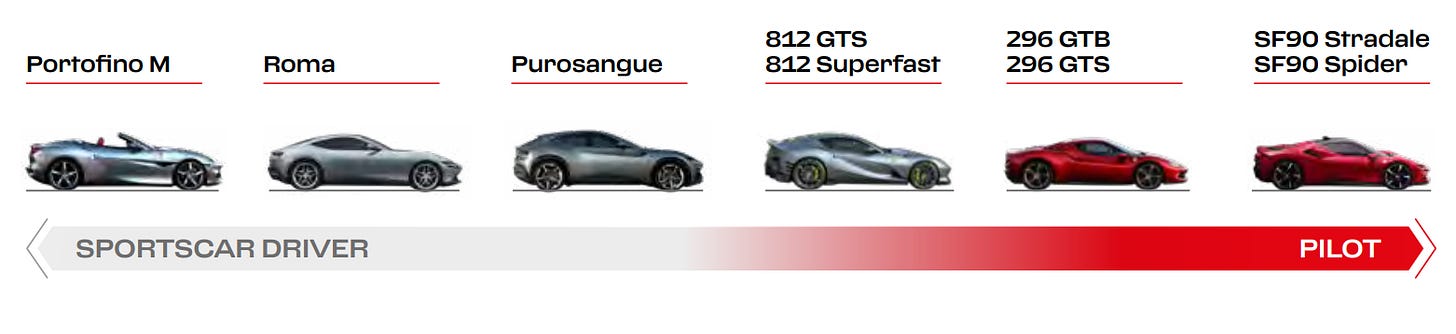

These range of cars also target end clients either on the spectrum of ‘Sportscar Drivers’, those who like driving in a variety of locations, or ‘Pilot’ drivers, those who like driving on challenging roads looking for an exciting driving experience (from the Portofino to the Spider, respectively):

Source: Ferrari Annual Report 2022

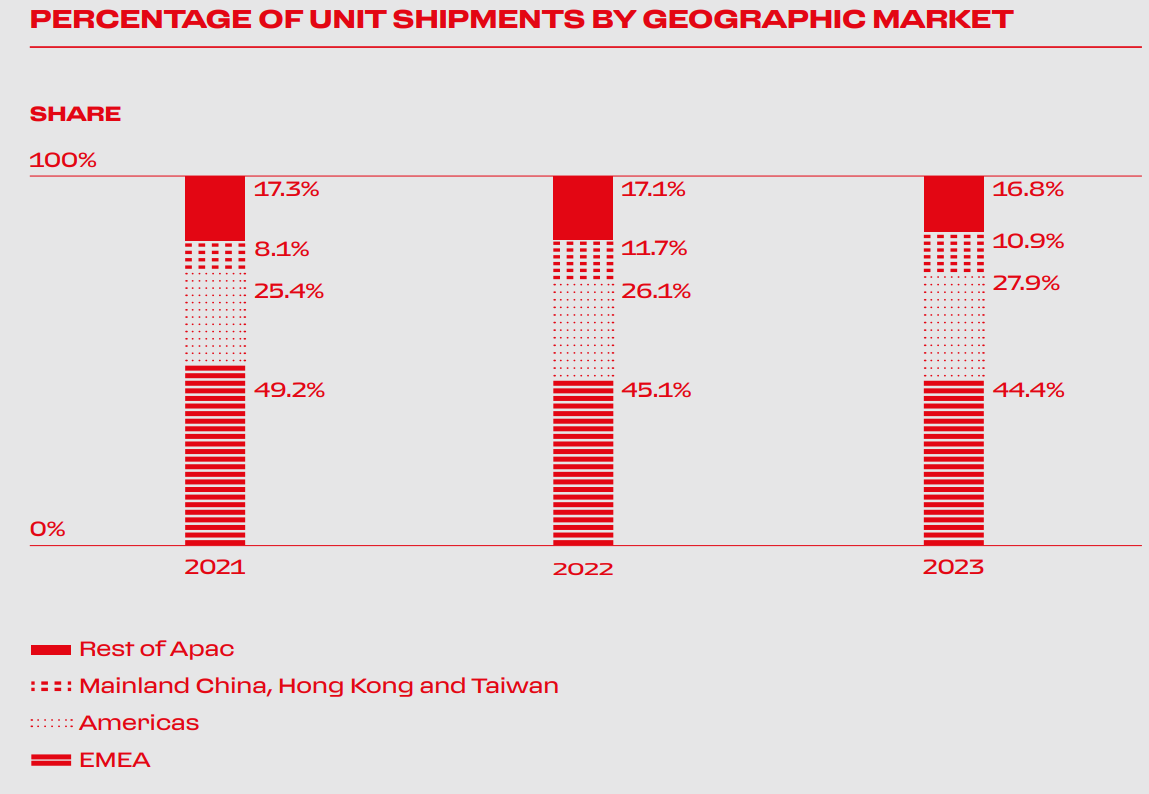

Going by geography, the largest geographic market for Ferrari is the EMEA region (44%), then the Americas (28%), Mainland China, Hong Kong and Taiwan (11%), and the rest of APAC at 17%.

Here are all the Ferrari dealerships and their locations scatted across the globe. As you can see, a majority of them are located in the EMEA region:

Source: Ferrari

When it comes to purchasing a Ferrari, the process is far from what you’d expect at a traditional car dealership. Forget walking into a showroom, picking out a model from the floor, and driving off the lot. Ferrari’s buying process revolves around exclusivity and customization, catering to its discerning clientele in ways that align with the brand’s luxurious image.

A common misconception floating around is that you need to buy a used or entry-level Ferrari (like a Portofino) first to qualify for a brand-new model, which is largely untrue. Perhaps some third-party exotic car dealers might try to perpetuate this myth to boost their own sales, but Ferrari's official dealerships don’t actually require you to buy a used unit first. It is easy to see where this rumor comes from: rarely can you walk into a Ferrari dealership and find a new car sitting in the lot waiting for you to buy. Ferrari prides itself on the philosophy that no two cars are alike. Each Ferrari is tailor-made to fit the exact specifications and desires of its buyer and so this means Ferrari doesn’t stockpile new cars for immediate purchase. Instead, you custom-build the Ferrari of your dreams, and only then does the company start production on your car to be shipped to the dealer.

This unique approach also plays a major role in delivery times. For a standard Ferrari model, expect lead times of up to two years, while more complex customizations or limited-edition models could extend that timeline to four or even five years. If you want a Ferrari faster, your only real option is to buy a pre-owned model from the limited stock available in the dealership.

The more complex and personalized your Ferrari is, the longer it will take to build. Some buyers with extensive histories of owning Ferraris or high-net-worth individuals might see slightly shorter wait times, but overall, Ferrari maintains a structured approach to their production queue. On rare occasions, if a buyer attempts to break too far from the brand’s design ethos, Ferrari might even reject certain custom orders to preserve the car’s core identity (some celebrities like Justin Bieber are apparently on the blacklist). This really shows Ferrari’s commitment to upholding its brand integrity, even at the cost of turning down business, and is something only a true luxury company can do.

A bit about Ferrari’s Culture

Ferrari dealerships also vary widely in atmosphere and customer experience. In some locations (especially in affluent areas like certain suburbs of Chicago), the dealership is welcoming and open to all, allowing potential buyers (and sometimes their families) to explore the cars up close. However, in high-traffic urban settings, stricter policies might be in place to prevent casual walk-ins from monopolizing the staff's time and space. Despite these variations, one thing remains consistent: Ferrari goes out of its way to make its customers feel valued at all times. Owners are often invited to exclusive driving events, tours, and experiences in the U.S. and Italy, fostering a sense of community and deeper loyalty to the brand beyond just a single transaction from company to customer.

Apart from building customer relationships at Ferrari dealerships, Ferrari also organizes various on and off-track events with existing and prospective Ferrari owners. These gatherings, which often feature appearances from Ferrari's Formula 1 drivers and senior management, give participants the chance to experience the brand firsthand. Guests can take part in driving experiences across Ferrari’s model range, and some even have the rare opportunity to drive an actual Formula 1 car. By bringing existing and potential customers into the Ferrari lifestyle in this unique way, Ferrari elevates its brand beyond the racetrack, generating excitement and loyalty that drives long-term interest and demand for their cars.

Benedetto Vigna, the current CEO of Ferrari, is also taking a refreshing approach by narrowing the gap between its employees and the luxury brand they help create. Luxury companies, including Ferrari, often stand as symbols of rising economic inequality, with many workers making products they themselves could never afford. Vigna, however, is addressing this disparity.

He recognized that many Ferrari employees had never even driven a Ferrari. In response, Vigna arranged for employees to experience the brand firsthand, bringing them to the test track to ride in the cars they helped build. This aimed to deepen their appreciation of their work and connect them more closely to the company's legacy.

Vigna even took this a step further by introducing an employee stock ownership program, offering every Ferrari worker a one-off grant of shares, worth approximately 2,065 euros. This is a unique move given that such programs are rare in Europe, though they are common in the U.S. Vigna’s time in Silicon Valley helped him understand the importance of giving employees a sense of ownership, aligning their incentives with those of shareholders.

In his words:

“The people are the center of the company. You need to motivate all of them. If you give shares, they all feel part of the company, like owners of the company. All companies have people. Only a few companies are made of people.”

— Benedetto Vigna, CEO of Ferrari

I find it very pleasing in the perspective of a shareholder that Ferrari knows how to strategize around their brand as a moat and form a company culture that pleases both employees and the end customer at the end of the day. That is ultimately the end goal for luxury companies and companies that continuously retain this strategy and culture do end up winning and continue to win. It’s important to keep track of this sort of culture and strategy with time to keep track of the brand moat. As the saying goes:

“Always remember that Rome was not built in a day, but Hiroshima and Nagasaki were destroyed in a day.”

Brands take literal whole generations to foster the emotions and feelings surrounding the brand for consumers, but it can take one misstep or mistake to ruin the brand entirely, especially with the advent of social media.

Formula 1 (F1)

I also wanted to discuss a little about Ferrari’s involvement in Formula 1 (F1).

Ferrari’s Formula 1 team serves as both a high-performance R&D lab and a key marketing arm for the brand. Maintaining an F1 team is one of the most expensive undertakings in motorsport, with the constant need to innovate to stay competitive. The team's continuous developments in engine technology, aerodynamics, braking systems, steering, and even battery management all contribute to the pursuit of racing supremacy. But the impact extends beyond racing itself.

The technological advancements made on the F1 side often find their way into Ferrari’s production vehicles, improving everything from engine efficiency to handling dynamics, and even design elements like aerodynamics. This transfer of innovations allows Ferrari’s road cars to evoke the same high-performance feel associated with its racing heritage, giving its customers—Ferraristi—a tangible connection to the brand's legendary Formula 1 success.

By intertwining its cutting-edge racing technologies with consumer models, Ferrari not only enhances the driving experience but reinforces its brand's reputation for producing vehicles that combine racing pedigree with luxury, cementing its place at the top of both the motorsport and luxury automobile worlds.

Millions and millions of people watch Formula One on TV and all the viewers recognize the flashy red on a Ferrari racing car with the brand visible for the whole world to see. If Ferrari wins, more attention and brand awareness is brought too.

Previously, many teams on the track in F1 operated at a loss and were heavily subsidized by sponsorships to survive, but nowadays with the recent growth in viewership and attention in recent years, Ferrari profits from F1. In fact, the ten teams from F1 have seen payments rise from $344 million to $435 million from 2022 to 2023, representing a 26% increase.

Competition

In terms of competition, Ferrari has a number of competitors in the automotive industry and this industry is saturated with a number of big players. These include:

Lamborghini

Porsche

Maserati

Bugatti

McLaren

Rolls-Royce

(Again, not an exhaustive list.)

There are also other competitors in the automotive industry, no doubt. One example is the ‘premium-tiered’ space of status amongst cars used for daily use, such as BMW, Audi, and Mercedes. This class typically has a wide range of options to choose from at various price ranges, and there are even many cars found in the second-hand market. Therefore, I believe they are not really as luxurious as the names listed above.

There are also other common car manufactures like Toyota and Ford who compete in the affordable range of cars for consumers. These are mainly the three distinct niches that operate in the automotive industry in the eyes of the consumer. Ferrari competes in the luxury niche against the names listed in the list above.

The most common argument I hear is that Ferrari, Lamborghini, and Porsche all compete in the same true luxury niche. I’d like to quickly dispute that claim.

Lamborghini, now owned by the Volkswagen Group, was famously founded as a direct result of a personal feud between Ferruccio Lamborghini and Enzo Ferrari. Ferruccio Lamborghini, originally a successful tractor manufacturer, purchased a Ferrari and found issues with its clutch. When he approached Ferrari's management to suggest improvements, Enzo Ferrari reportedly dismissed him, suggesting that Lamborghini should stick to tractors and leave sports cars to Ferrari. Insulted by this, Ferruccio Lamborghini set out to create his own line of luxury sports cars that would directly rival Ferrari’s. This marked the beginning of the Lamborghini brand, which has since grown into a major competitor in the world of high-performance supercars. Today, it is known for its sleek and flashy cars like Ferrari, and is a popular name among mainstream media. This is why you see so many famous celebrities and rappers sporting around with a Lamborghini. And I’ve got to say, the cars they make are definitely luxurious:

While Lamborghini competes in the luxury space, it has yet to achieve the distinction (in my opinion) of being a true luxury brand. Its appeal often skews towards a different audience—rappers, controversial figures, and young adults chasing quick wealth—who, while capable of affording the premium price tag, contribute to a perception that detracts from the exclusivity typically associated with luxury.

This demographic is often linked to a bold or polarizing lifestyle that ultimately diminishes Lamborghini's allure as a sophisticated brand in the eyes of many. In contrast, Ferrari has successfully maintained its prestige, with the affluent and ultra-wealthy clearly recognizing it as the superior choice for status and refined luxury.

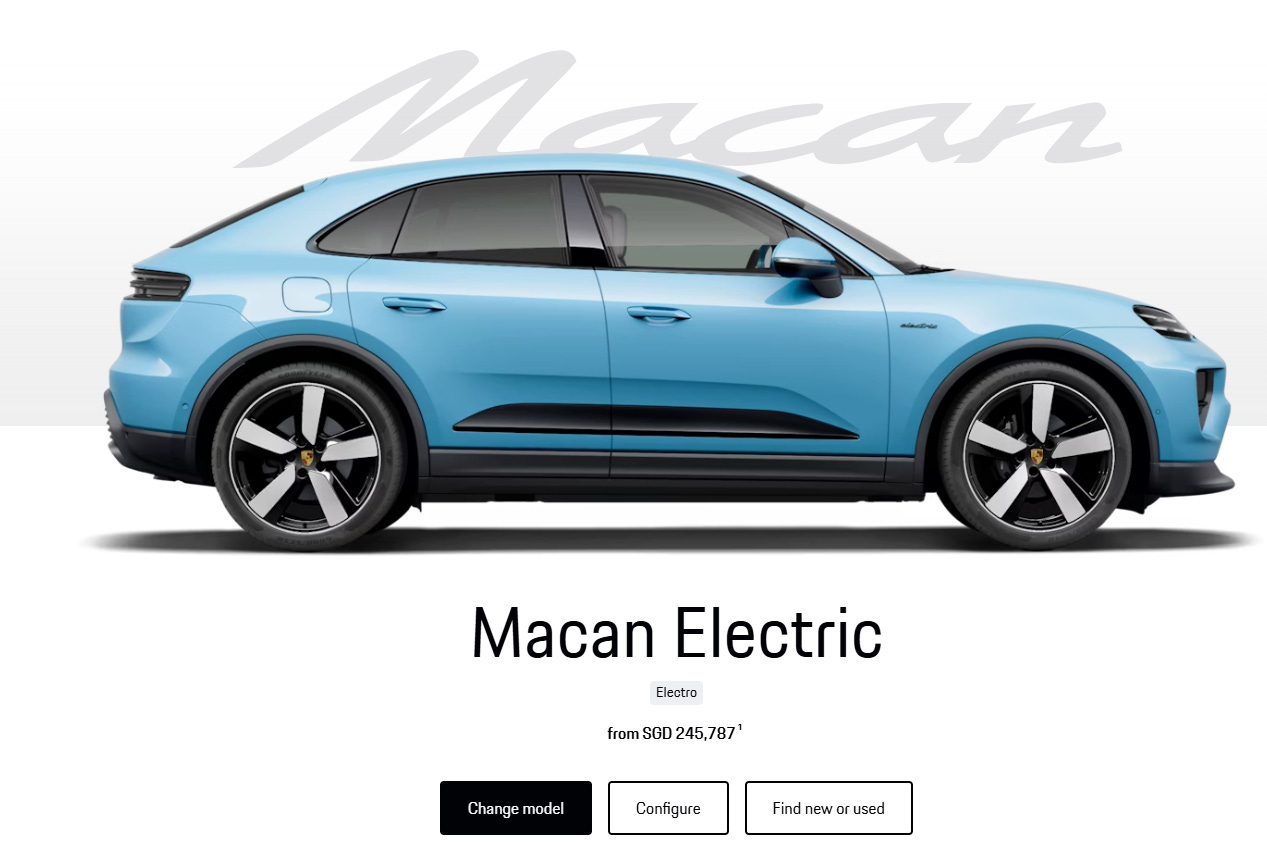

Now on the case of Porsche (again part of the Volkswagen Group like Lamborghini), while Porsche certainly has its allure as more entry-luxury brand, especially with models that are more difficult to obtain, it stands in a completely different realm compared to the true luxury of Ferrari. Porsche’s strategy involves broadening its product line to include accessible models like the Macan and Cayenne SUVs—vehicles that you’re likely to see in almost every affluent neighborhood. While these cars are still priced higher than average, they contribute to the brand accessibility of Porsche, making Porsche more of an everyday luxury (perhaps even almost premium-tiered due to the wide array of their product lineup) which erodes exclusivity.

This is vastly more accurate and evident in expensive cities where a large proportion of the population may have a higher average income than most cities. Take Singapore, for example (where I currently reside in), which is one of the highest median income cities in the world. I often see many Porsches driven around than Ferrari sightings because of the simple fact that Porsche offers vast tiers of Porsche models at various price points (most common Porsche I see is the Porsche SUV Macan or Cayenne). Porsche even offers a “Find new or used” option to consumers which I find is contradictory to the idea of a ‘luxurious’ status (it is clearly trying to cater to a wider range of audiences, not just the wealthy, diluting the brand).

It is important to note the fact that both Lamborghini and Porsche operate under the umbrella of the Volkswagen Group, which raises significant questions about their brand exclusivity. Sure, you could argue that it is important to only evaluate the luxury status of a brand on its own merits, but at the end of the day being part of a larger conglomerate that caters to a wide range of consumers across various price points diminishes the true exclusivity that defines a high-end brand. By positioning themselves within a larger portfolio that includes more accessible vehicles, Lamborghini and Porsche inadvertently dilute the perception of rarity and luxury that companies like Ferrari maintain by remaining independent. The Volkswagen Group currently owns 10 car brands, including:

Lamborghini

Porsche

Volkswagen

Volkswagen Commercial Vehicles

SKODA

Bentley

SEAT

CUPRA

Audi

Ducati

Ferrari, on the other hand, is a pure-play luxury company that operates on an entirely different frequency. The idea of overproduction is abhorrent to its brand DNA. Ferrari is all about preserving the mystique, the scarcity, and the unparalleled artistry of a machine that is tailored, quite literally, to the desires of its owner. Where Porsche might flood the market with entry-level models, Ferrari’s philosophy is about keeping demand insatiably high by intentionally restricting supply, keeping the status of Ferrari as a true luxury.

This distinction is key: while Porsche and Lamborghini might be desirable, it is nowhere near the echelon of exclusivity that defines Ferrari. Therefore, it does not seem wise to compare business metrics and valuation to them since it is not a fair comparison.

From the intelligent quality investor’s standpoint who is looking to invest in the top 1% of quality companies in the world, it may not make sense to invest in the Volkswagen Group even if they own Lamborghini and Porsche given the vast number of brands they own that strays away from such a quality standard.

Pricing power

What is pricing power?

Pricing power is the continuous ability to raise prices above the rate of inflation without incurring a meaningful loss in demand.

Ferrari’s pricing power is a fundamental part of its business strategy, allowing the brand to maintain its exclusivity amidst a wealthy and growing customer base. In theory, Ferrari is “forced” to raise prices annually, not as a reaction to inflation but to preserve the luxury experience for its affluent clientele who were getting richer exponentially. Without these price hikes, Ferrari would risk diluting its exclusivity that makes the brand less desirable for high-net-worth individuals who view owning a Ferrari as a status symbol. Unlike other automakers that face economic cycles and price sensitivity, Ferrari has perfected the art of scarcity by deliberately limiting production, creating demand that allows for price increases without losing customers.

Because Ferrari constantly increases its prices year-over-year, customers pay for a Ferrari now than later due to inflationary expectations that the price of the car would increase the next year. This increases the demand for the product even more so.

As long as Ferrari’s supply of cars is always below the level of demand in the market, Ferrari will be able to flex its pricing on the cars it makes, especially at the limited edition tier of cars it offers to its extremely wealthy customers. To illustrate this example:

In 2010, Ferrari produced 6,573 cars and today in 2024 that number has doubled. Over the same period, the number of billionaires globally has more than tripled. The demand has clearly surged as more people get richer, but supply has lagged demand.

Ferrari also circumvents the tradeoff between volume growth and exclusivity by releasing new models and series of cars that have a cap at the start of production on each model so that Ferrari can both grow its sales while retaining the exclusivity to a cap on each Ferrari model that a consumer buys. I found this to be an effective and innovative way to go around this ‘dilemma’.

As a result of expanding its car model categories, Ferrari can effectively flex its pricing power on limited edition or special edition models that are exclusive to only loyal and known Ferrari customers that are typically more wealthy. Much of the pricing power is flexed in this area where there is much customization and personalization to be done from the individual parts, to the tires, and so on.

All of these strategies are kept in mind that ever so slightly increases the company’s pricing power over the extended period of years that it has existed. I would say that its pricing power is the strongest it has ever been in history today.

An interesting fact I found was that, out of the top 30 most expensive cars ever sold in auction, Ferrari dominated with 23 of the 30 of the list. Feel free to check it out yourself:

The 30 Most Expensive Cars Sold at Auction

The Number #1 on the list is the Ferrari 250 GTO which sold for a whopping $38,115,000 at the Bonhams Auction, in Carmel, Calif of August 2014.

4) Financials

Since the inception of the automobile in 1886, over 2,000 carmakers have tried to break into the market, but most have ultimately failed. The auto industry is notoriously competitive and capital-intensive, forcing companies to depend heavily on debt to maintain operations. Additionally, it is a highly cyclical sector, where demand drops dramatically during economic downturns, as consumers delay major purchases like vehicles. Why would anyone want to invest in an industry that operates like this?

This volatile environment leads to uneven and unpredictable earnings, and many automakers struggle with negative Free Cash Flow (FCF), making survival exceptionally difficult. This combination of debt reliance, economic sensitivity, capital requirements, and competition shows the precarious nature of the industry and why many manufacturers struggle to sustain profitability.

Therefore, the intelligent quality investor should choose the most dominant and predictable business that is able to grow its FCF over time reliably without leverage into perpetuity to mitigate the risk of loss of permanent capital if their time horizon is long.

Valuation is the most important thing if your time horizon is within 12-24 months or so, but the quality and durability of the business is a lot more important than the price paid if your time horizon is 5, 7, or 10+ years. Buy right and sit tight.

Nowadays, I see a lot of stocks gaining traction on Fintwit that often have a ‘story’ or a narrative connected to the stock, and there is lots of cult behavior circulating online with many people tying an emotional connection to the stock. The ‘story’ is important, but the fundamentals and quantitative metrics are ultimately what drives the stock in the long term, focusing on growth from FCF in share price appreciation rather than market timing the stock price through multiple expansion without the profits to show for it.

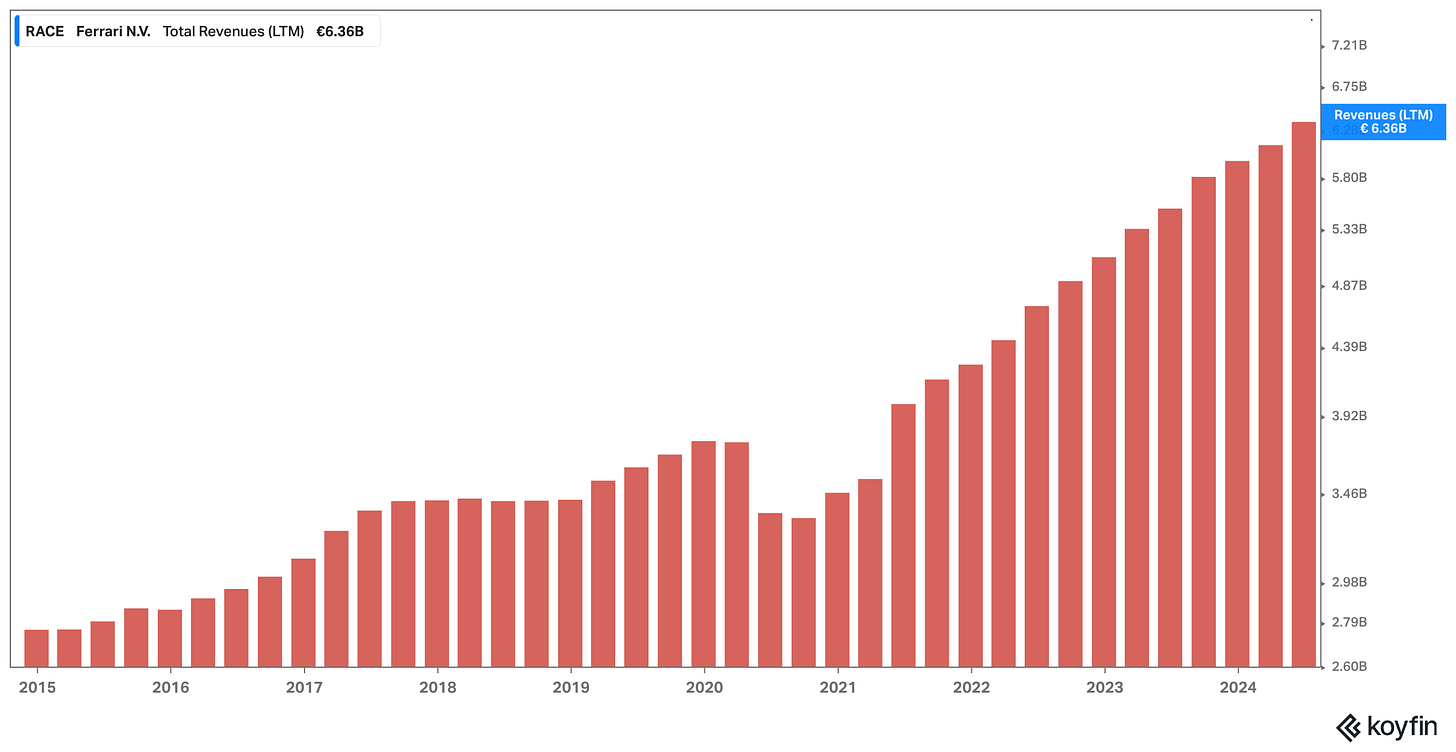

Revenue growth has compounded at roughly 8.7% CAGR since 2015 to the present day. I find this growth to be very pleasing since, although 8.7% is not something very amusing, it definitely is very healthy for a luxury company and the graph above has shown that revenue growth has been very stable and predictable, something a lot more valuable than rapid revenue growth. If a luxury company like Ferrari were to grow by high double digits, I’d be concerned, as the rapid increase in unit volume could erode the brand’s image of exclusivity. Ferrari’s primary objective is to retain exclusivity at all costs and if that means in the high single-digit growth range, so be it. Overall, solid and predictable growth (especially in recent years!).

“Our ethos remains the same; quality, quality of revenues over quantity.”

— Benedetto Vigna, CEO of Ferrari, during the Q2 2024 Earnings Call

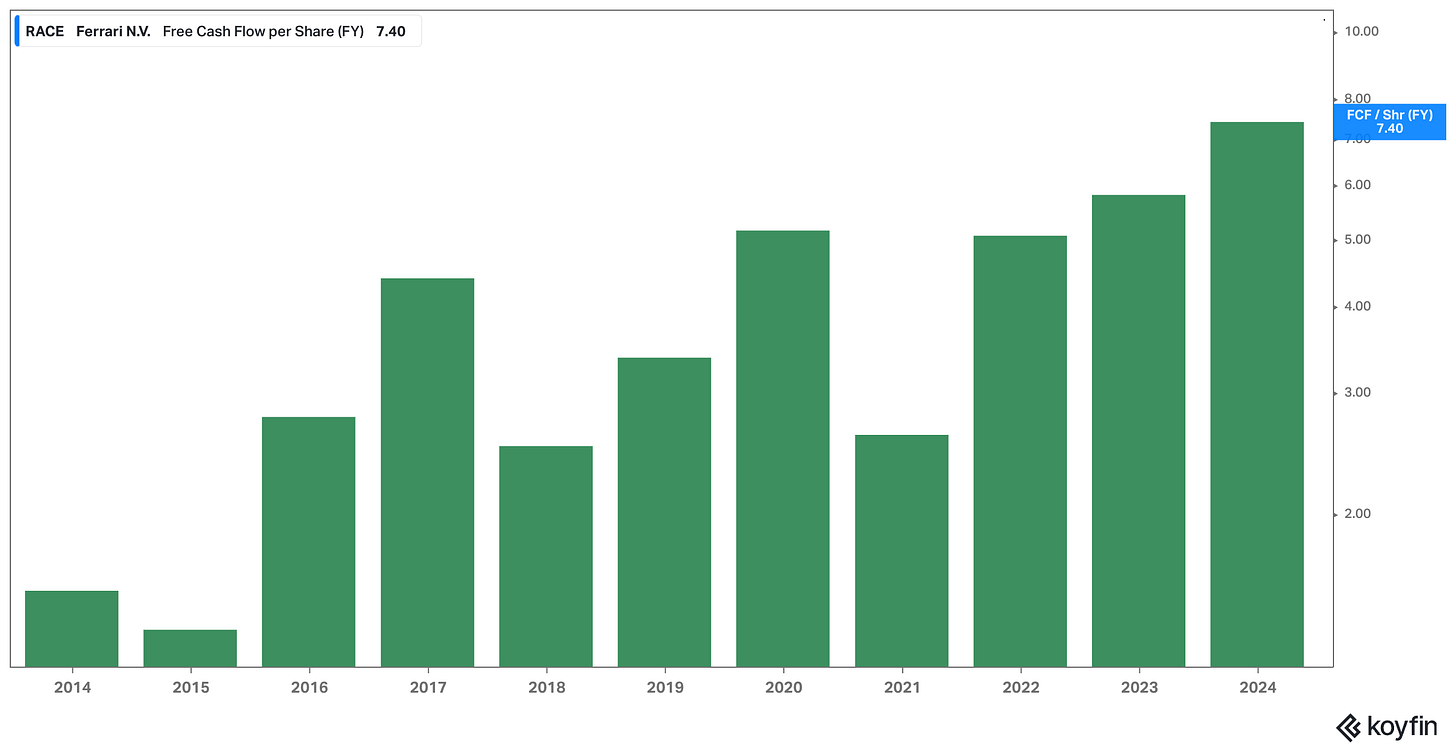

Ferrari has compounded their free cash flow per share by approximately 19.3% CAGR for the past 10 years! That is no easy feat for a company that is only average but is only possible when there is something magical going on that makes a company a quality one, like Ferrari. The free cash flow per share growth is ultimately what a company needs to maximize the most to grow the intrinsic value for shareholders in the long run

(PS: In case you were wondering about stock based compensation, SBC only represents around 3-4% of FCF)

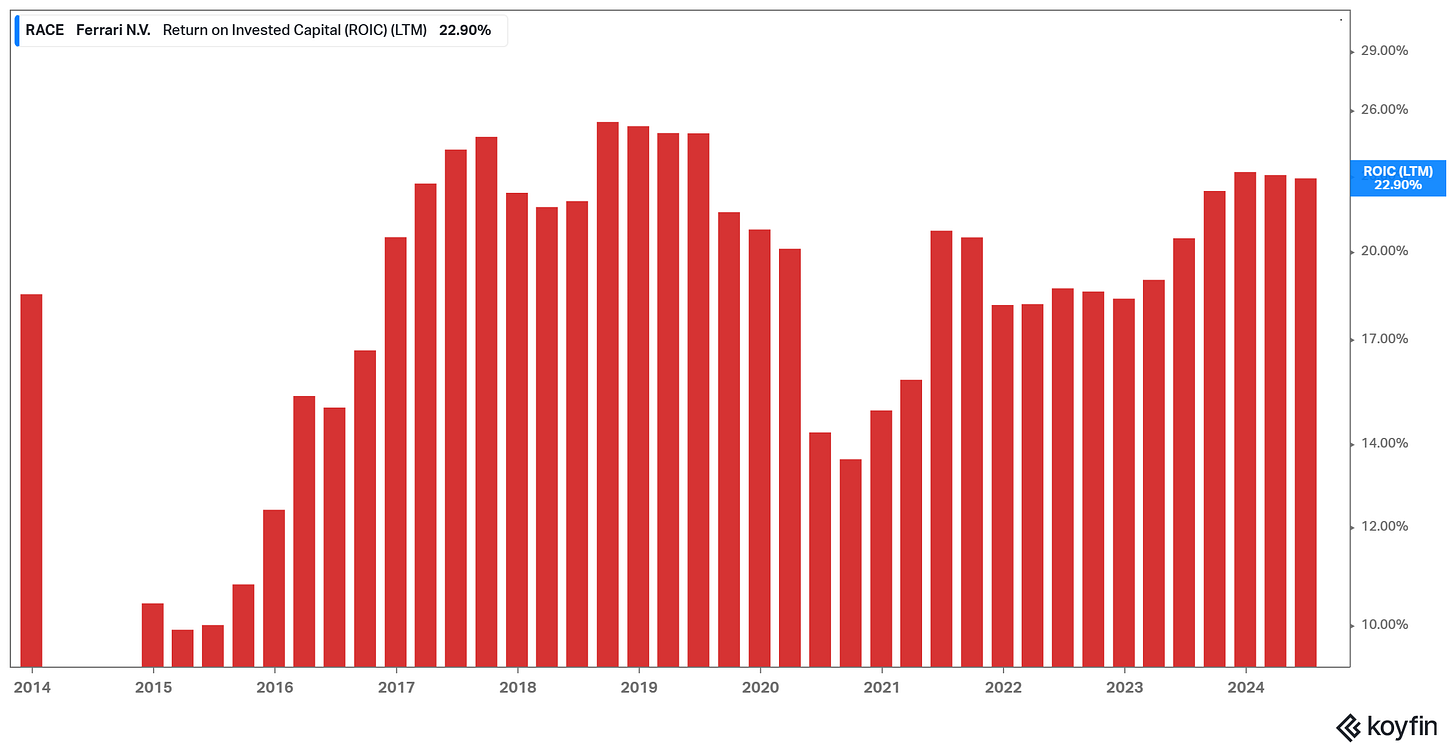

Ferrari’s return on invested capital (“ROIC”) looks great here too, nothing to complain. ROIC has been sitting at, on average, above at least 18% in most years. This is a sign of strong capital allocation and an enduring economic moat.

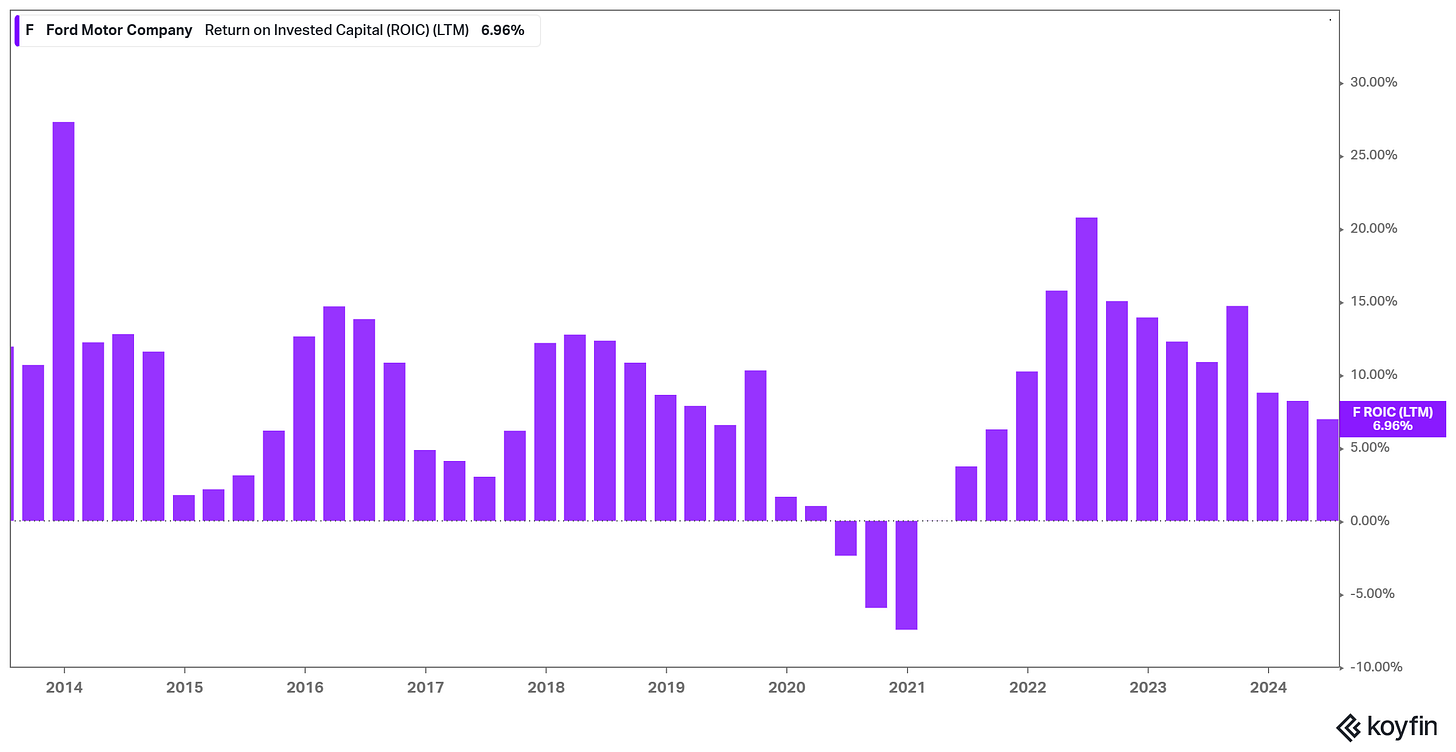

Let’s also compare it to some other automotive companies in the industry. Popular names such as Ford:

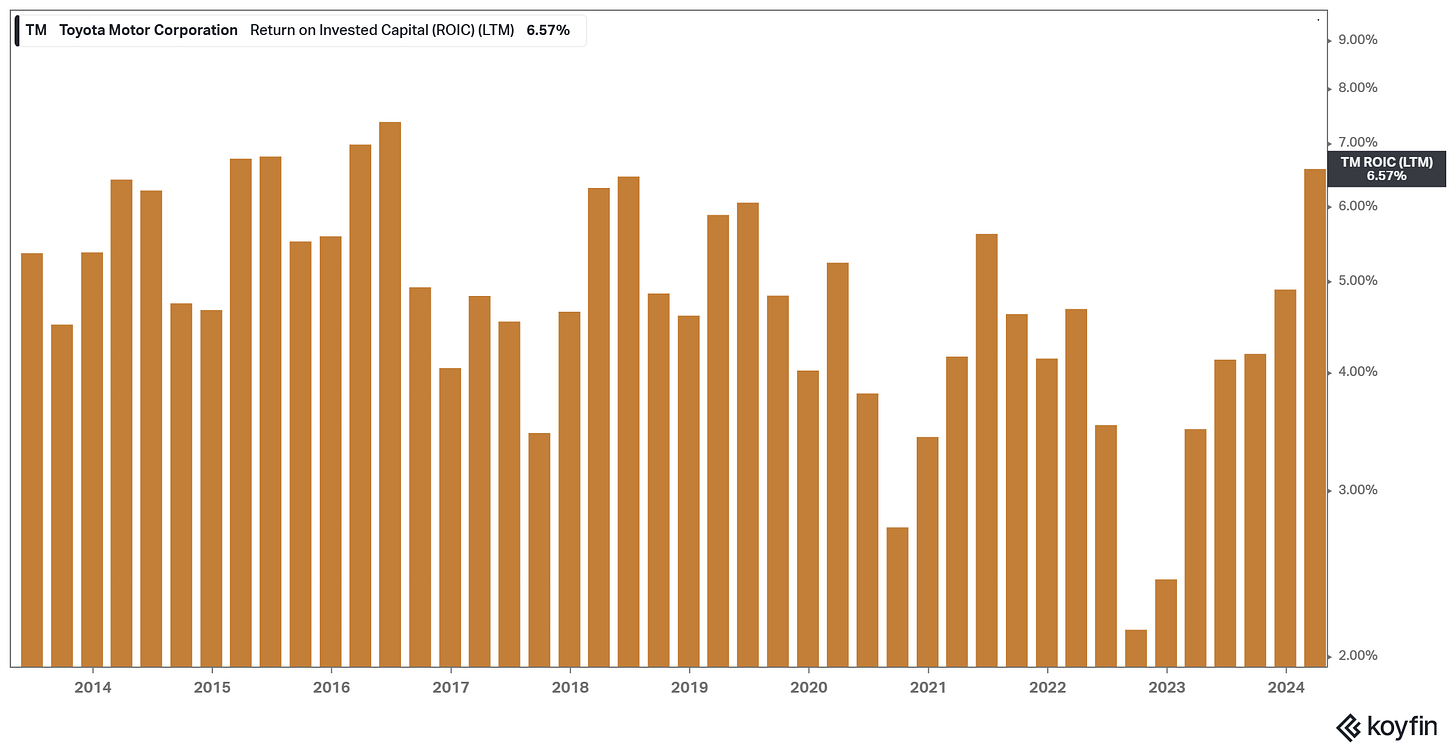

Toyota:

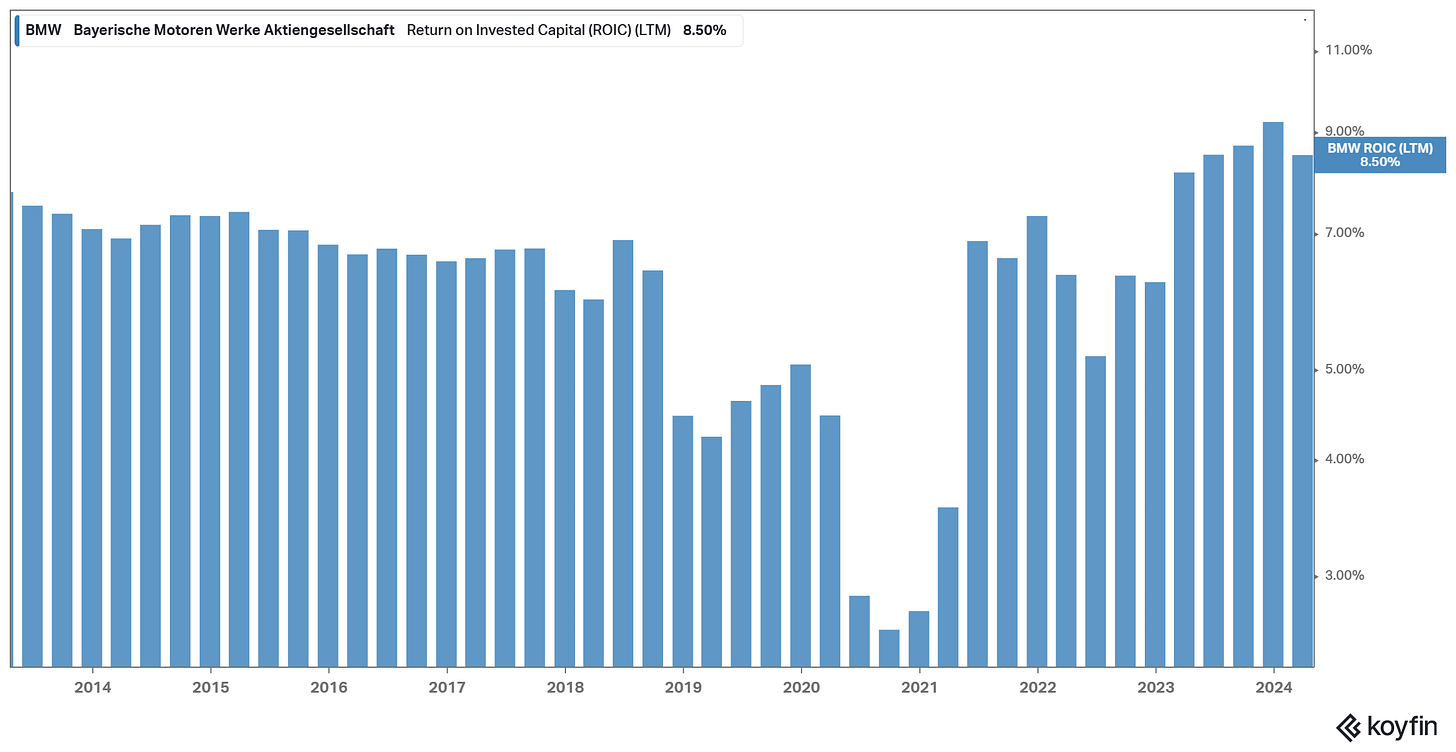

These returns have not been attractive over the past decade. Ford’s has been drastically inconsistent, even at times reaching the negatives, and Toyota’s has never broken past even 9%. Shocking! If you’re still not convinced, let’s look at other, more premium automotive companies as a somewhat fairer comparison. Take BMW, for example:

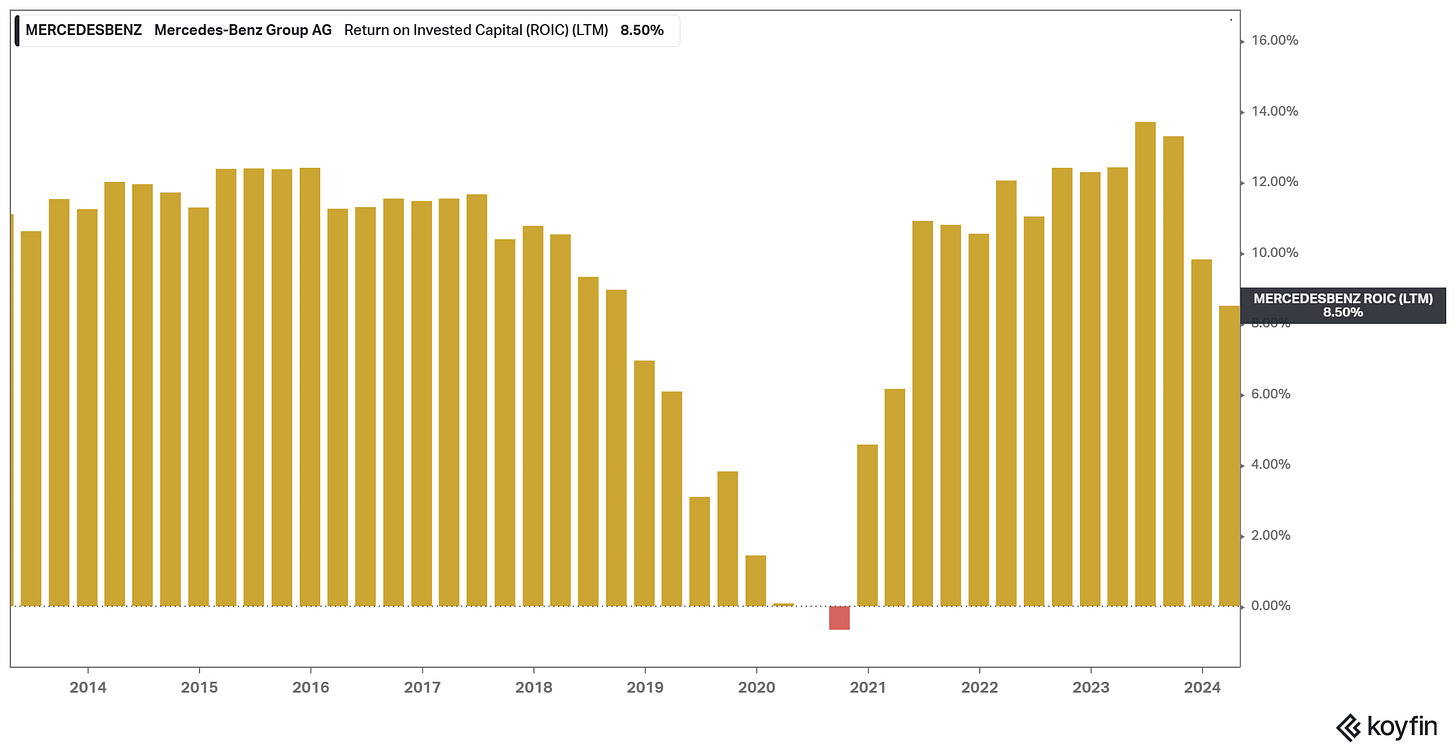

Mercedes:

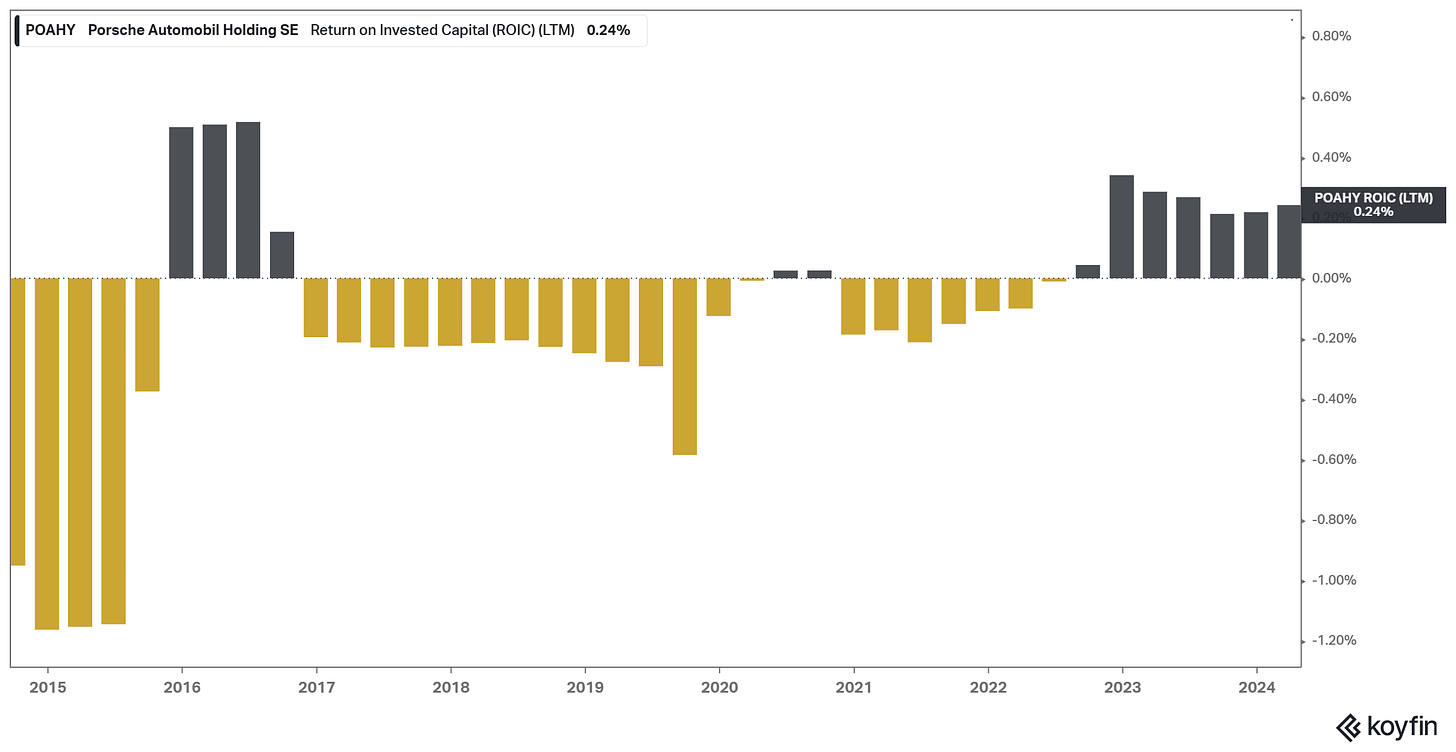

Porsche:

As you can see, all of these automotive companies have a much lower ROIC than Ferrari in comparison, with most of them earning a return below their cost of capital (value destructive). As a result of this awfully low returns on capital, the market recognizes this and all of these companies have underperformed the index (except Ferrari, of course).

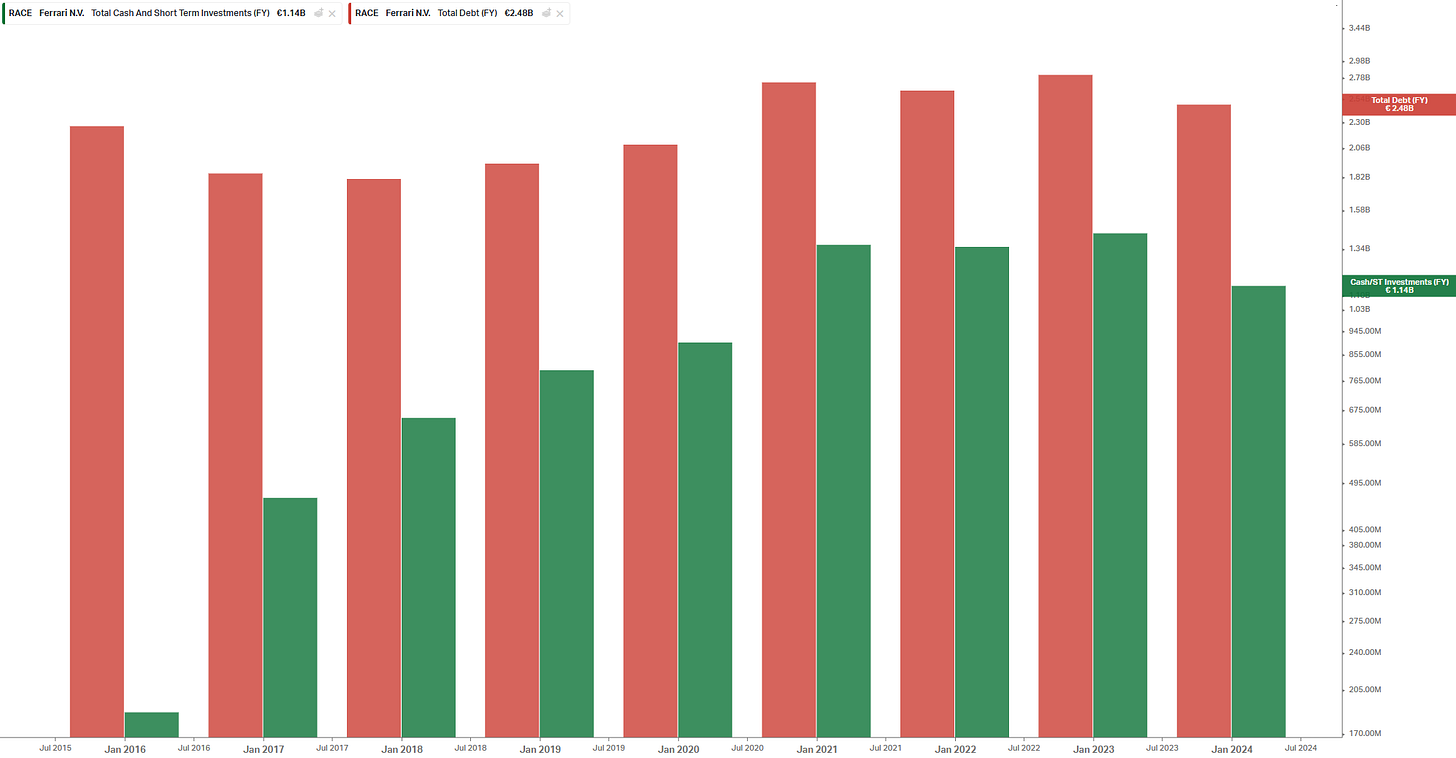

Ferrari also manages its balance sheet well. Although total debt exceeds total cash, I don’t see this as a considerable danger or red flag to the company going forward. There hasn’t been a noticeable or alarming tick up in total debt and total debt has remained relatively stable.

Furthermore, the current ratio, a liquidity ratio that measures a company's ability to pay short-term obligations or those due within one year, is 1.54, meaning that Ferrari’s financial situation is not at all alarming or concerning.

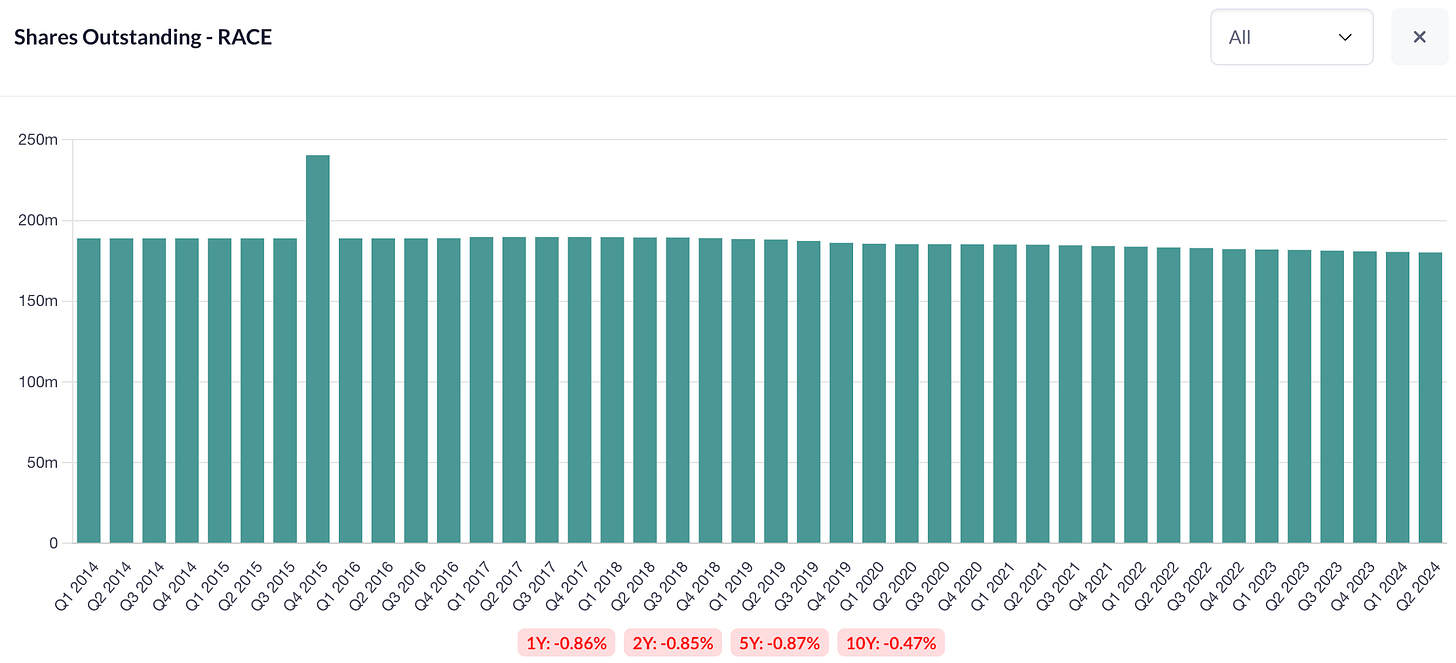

Looking at other quantitative metrics, shares outstanding has decreased by -0.47% in 10 years and -0.87% per annum in the past 5 years. This is definitely something favorable for the investor but these numbers do not seem to be very material in the long run anyway (good to see decreasing shares outstanding nevertheless):

(P.S: The above is a tool called Qualtrim that I’ve been using recently and it displays data quite neatly. Pretty fun to use.)

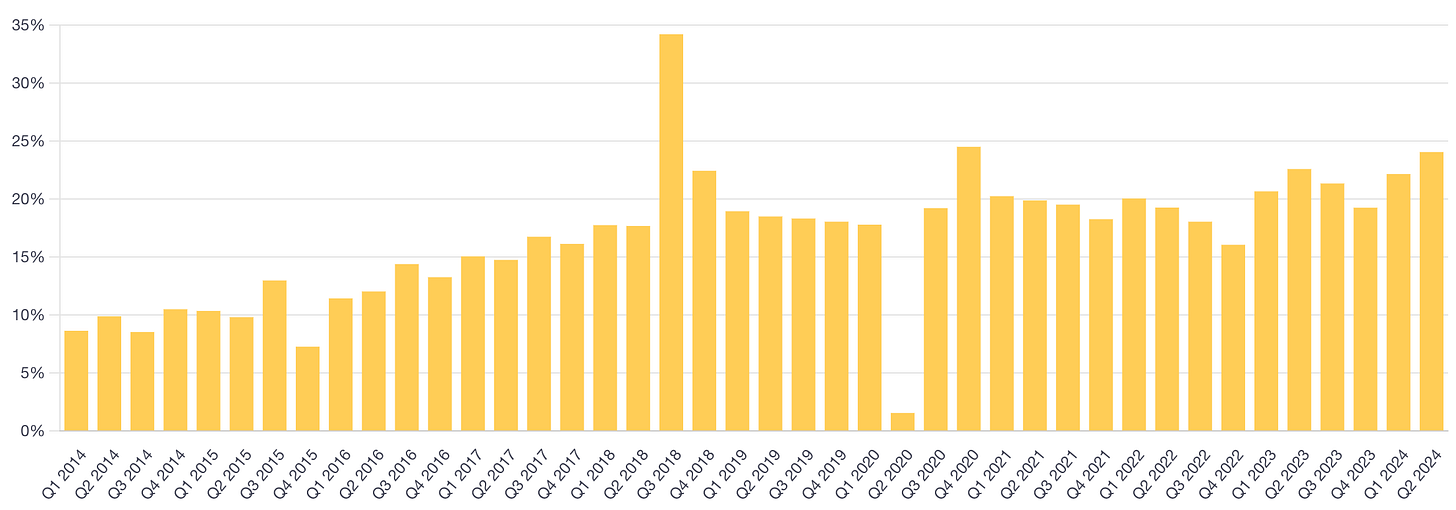

Net profit margins have also remained consistent over the years (but more in recent years) and have averaged at roughly 20%, something spectacular for an automotive company but of course nothing surprising given that Ferrari is a luxury company at the end of the day charging higher prices for their luxury and custom-designed cars:

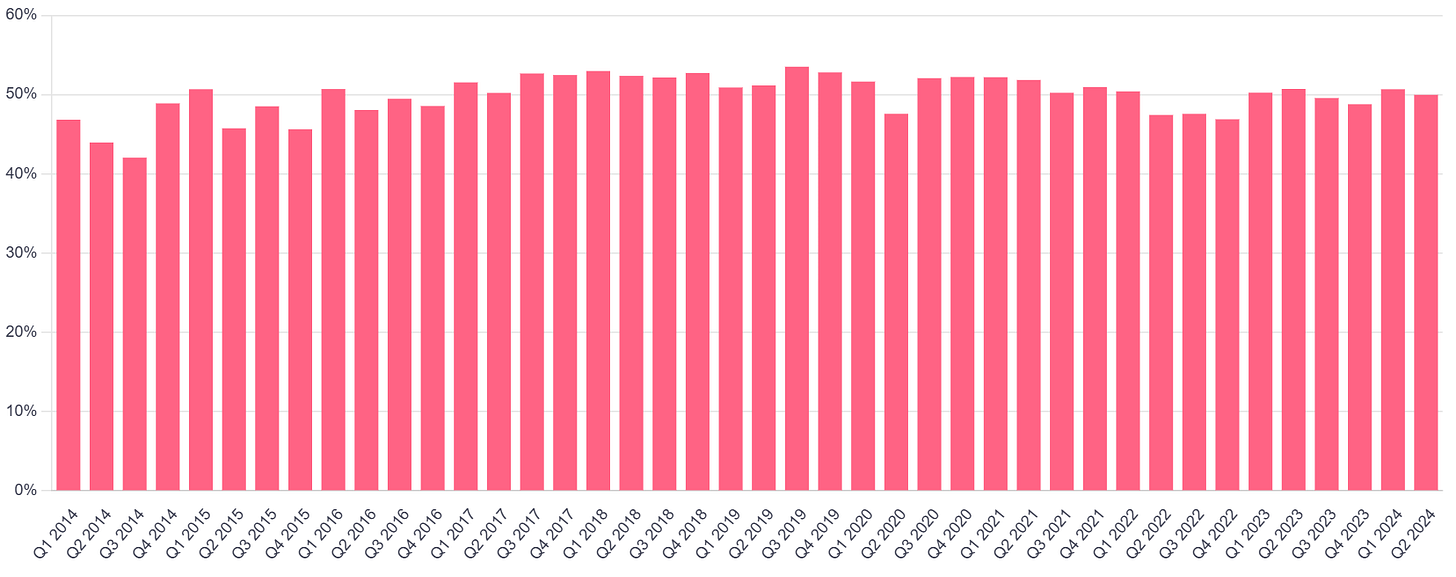

Besides net profit margins, in case you were interested, gross margins have consistently been sitting at around 50% gross margins which is significantly higher than the industry average (somewhere below 20%):

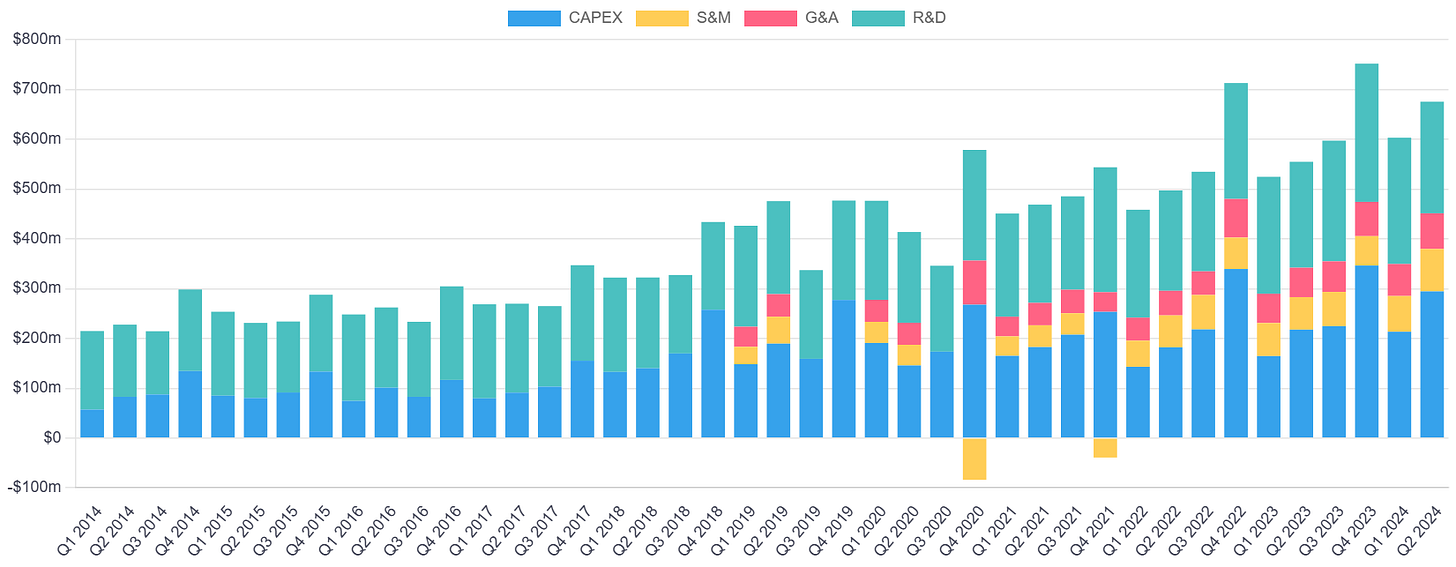

Now looking at the expenses in the graph below, you might find that the Sales & Marketing expenses (S&M) are a very small portion of Ferrari’s total expenses over its lifespan. In fact, in just Q2 2024, S&M only represented around ~3% of total expenses. Why is that? Ferrari spends nearly zero dollars on advertising with only the Formula One segment of their business to be considered as the advertising channel for the brand. Ferrari knows that its affluent customers will buy their cars, with or without advertising campaigns and by this point, the whole world knows about Ferrari. So they don’t have to spend extra cash to pay for advertising and customers will still simply buy Ferrari cars:

Additionally, CAPEX represents 43% and R&D at 33%, both amounting to more than 75% of total expenses. It is no surprise given that at Ferrari is ultimately a car company, so expenses like running the manufacturing and production facilities for their cars, machinery for each stage of the production line, design centers, and opening up new dealership stores around the world would obviously be the largest expense for a company that manufactures and sells physical, tangible products.

Ferrari has to spend a lot on R&D to maintain its competitive edge in Formula One in building the ultimate racecar, which includes developing new technology for aerodynamic improvements, lightweight materials, more efficient engines, investments in vehicle testing tracks (this could be part of CAPEX too), prototype development workshops, and etc. The Formula One competition is very fierce with new technologies introduced every year from each competitor to make their own racecar the fastest it can be, so the risk of underinvesting is dramatically greater than risk of overinvesting (also a common theme nowadays with Big Tech CAPEX for data centers).

5) Opportunities

This section will go through some potential opportunities going forward in the future that can add to the bottom-line.

5.1 Growing into emerging markets (?)

Thanks to Ferrari’s status in the luxury space as one of the dominant players in the market, the company can effectively control pricing and therefore control the growth rate going forward (which makes forecasting somewhat more predictable).

China (and a larger Asia) is probably the number one biggest market for luxury goods as there are more and more Chinese millionaires and billionaires growing faster than in other countries that have already experienced growth over the past decades. Especially so, a large percentage of customers even buying in foreign countries like in the United States are also Asians, so the Asian market makes up a huge opportunity for Ferrari.

I listed this opportunity as a “?” because if Ferrari were to expand into emerging markets, it would chip away at the exclusivity of the brand and dilute it even more if more and more Ferrari cars are seen on the streets in even emerging markets. This is something to be careful of if it is an ‘opportunity’ (I view it as a double-edged sword).

5.2 Product categories outside selling just cars

Ferrari already has product categories outside of just selling cars, such as amusement parks (i.e. Ferrari World Abu Dhabi), watches, belts, premium clothing, and even Mahjong boards! (This list is not exhaustive.)

Again, this opportunity is one of those opportunities that have a double-edged sword like the previous. If Ferrari is able to execute into these other product categories well, it is very well an opportunity (as long as it does not dilute the brand whatsover).

6) Risk Factors

In this section, we will just go through some potential risk factors for the company.

6.1 Brand reputation issues

If something were to happen that would negative impact Ferrari’s brand perception, that could, at least in the short-term, affect Ferrari’s brand moat. Ferrari has to continually manage and maintain the allure, exclusivity, and true luxury perception to its customers at all times and at all locations. The disadvantage of Ferrari being a standalone luxury company compared to, say, LVMH, is that one bad story can dilute the whole brand. If, for example, LVMH had a reputational issue or negative story in one of their brands, they could contain it a lot more effectively without much spilling to its whole umbrella of other brands. However, the advantage of this is that Ferrari is able to allocate all of its efforts and energy into maintaining and building one brand, which in my opinion is a lot easier and effective as a luxury company.

On this topic of brand reputation, it is important that Ferrari stays patient and not become complacent to growing at a faster and larger clip. Staying true to the idea of exclusivity has always been the luxury strategy and there has been a number of luxury companies that have fallen into the trap of diluting their brand by selling too many of the same product, and so forth.

A prominent example of this would be Louis Vuitton. Louis Vuitton is one of the most well-known brands in the luxury handbag market, but it has arguably diluted its luxury product being the handbag in recent years. 92% of Japanese women own a Louis Vuitton bag, and while that may seem like impressive numbers, the idea of luxury is to limit supply and sell the idea that the product is scarce. If almost every woman in Japan owns a Louis Vuitton bag, it may lead many consumers to now think that Louis Vuitton is actually very accessible. (Perhaps Louis Vuitton should reevaluate its luxury strategy if this statistic is accurate.)

6.2 Geopolitical factors

With the recent wars from Ukraine-Russia and Gaza, along with a majority of risks linking to China (given that a large portion of total revenues are found in China), Ferrari’s sales could be disrupted by one-time Black Swan events.

Given that Ferrari is a car company and is heavily reliant on CAPEX from its production and research facilities, raw materials, equipment, and many more physical, tangible parts that make the Ferrari car, it is a very real risk that could affect Ferrari’s sales.

6.3 Failure to appeal to newer audiences

Ferrari is an old and traditional Italian brand, which has attracted the older demographic client audience. Lots of Ferrari collectors are considered ‘old money’, and as the current active client base starts to grow older and retire, Ferrari will have to try to appeal to newer generation audiences who will inherit this money.

Additionally, the prevalence of Lamborghinis in today’s pop culture, especially within rap music and scammer culture, shows us an important distinction between Lamborghini and Ferrari’s brand image. Lamborghinis are frequently referenced in rap songs and used by individuals who flaunt wealth or success, particularly in superficial or flamboyant contexts. The car has become a symbol of flashiness, favored by young people as a "cool" status symbol amongst the younger generation. Its frequent association with get-rich-quick schemes and individuals trying to project a high-rolling image could dilute its prestige in some circles.

This is just one of the examples of these “get-rich-quick” schemes:

Ferrari, by contrast, has historically maintained a more refined and exclusive image, often avoiding the same level of commodification. It is rarely used in the same way in rap culture, likely because it represents a different tier of luxury and exclusivity. The brand's focus on heritage, performance, and motorsport sets it apart from Lamborghini’s more accessible, "in-your-face" persona.

However, Ferrari's future growth could hinge on maintaining its ‘cool’ factor among younger demographics. If Ferrari fails to engage this audience or adapt its brand to current trends, it risks losing relevance. A shrinking customer base could negatively impact both pricing power and volumes, as well as the all-important second-hand market that thrives on exclusivity and desirability. To avoid this, Ferrari must continue to cultivate an aura of aspiration while balancing exclusivity with cultural relevance.

7) Valuation

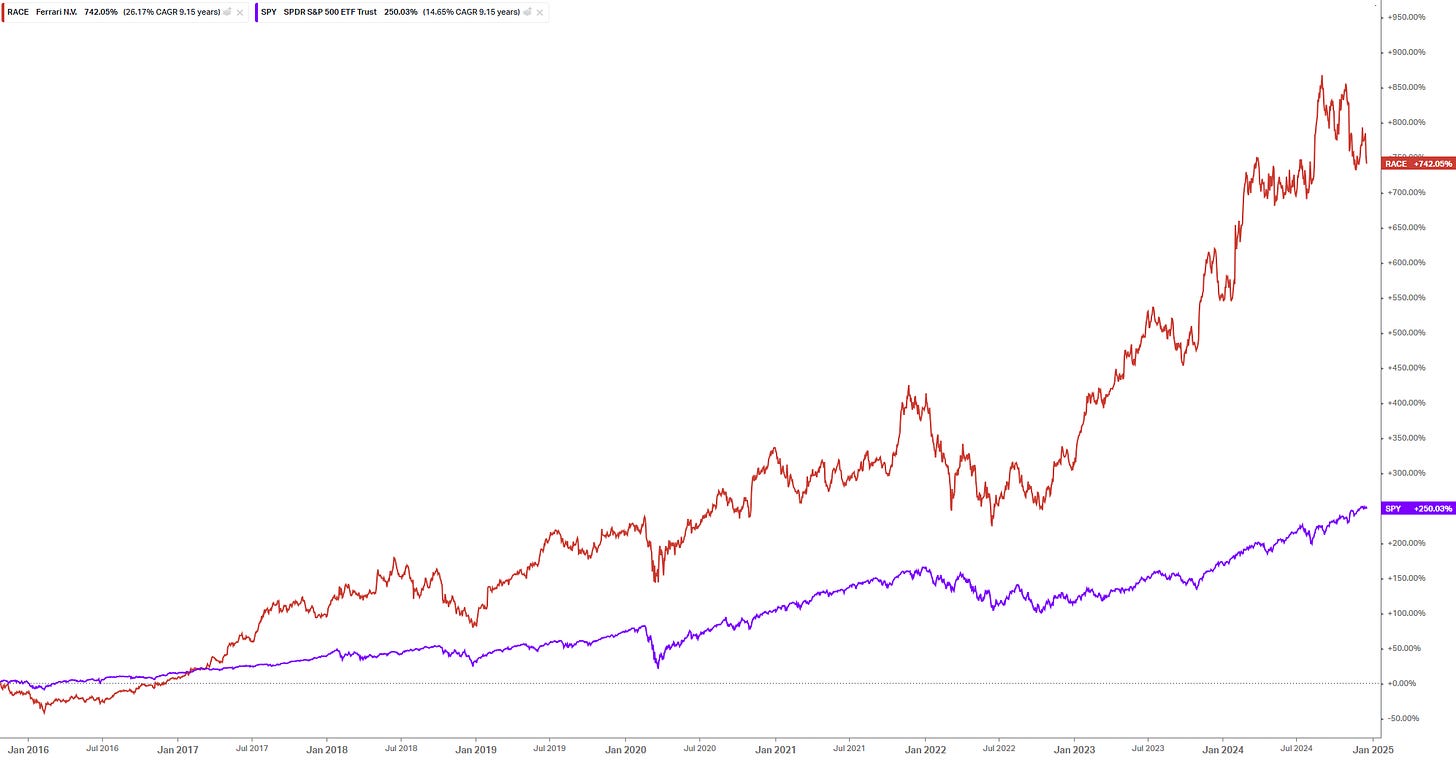

We try to invest in companies who have compounded over long and sustained periods of time that beat the S&P500 by a a considerable margin. If it has not beaten the S&P500 in the long term, why bother investing in the company?

We can see that over the past 9 years (when Ferrari RACE 0.00%↑ IPO’d), Ferrari has outperformed the S&P500 by a significant margin: +742% vs +250%! (as of this time writing.) This is a 26% CAGR for Ferrari since 2016 to the present day. Clearly there is something magical going on with this company.

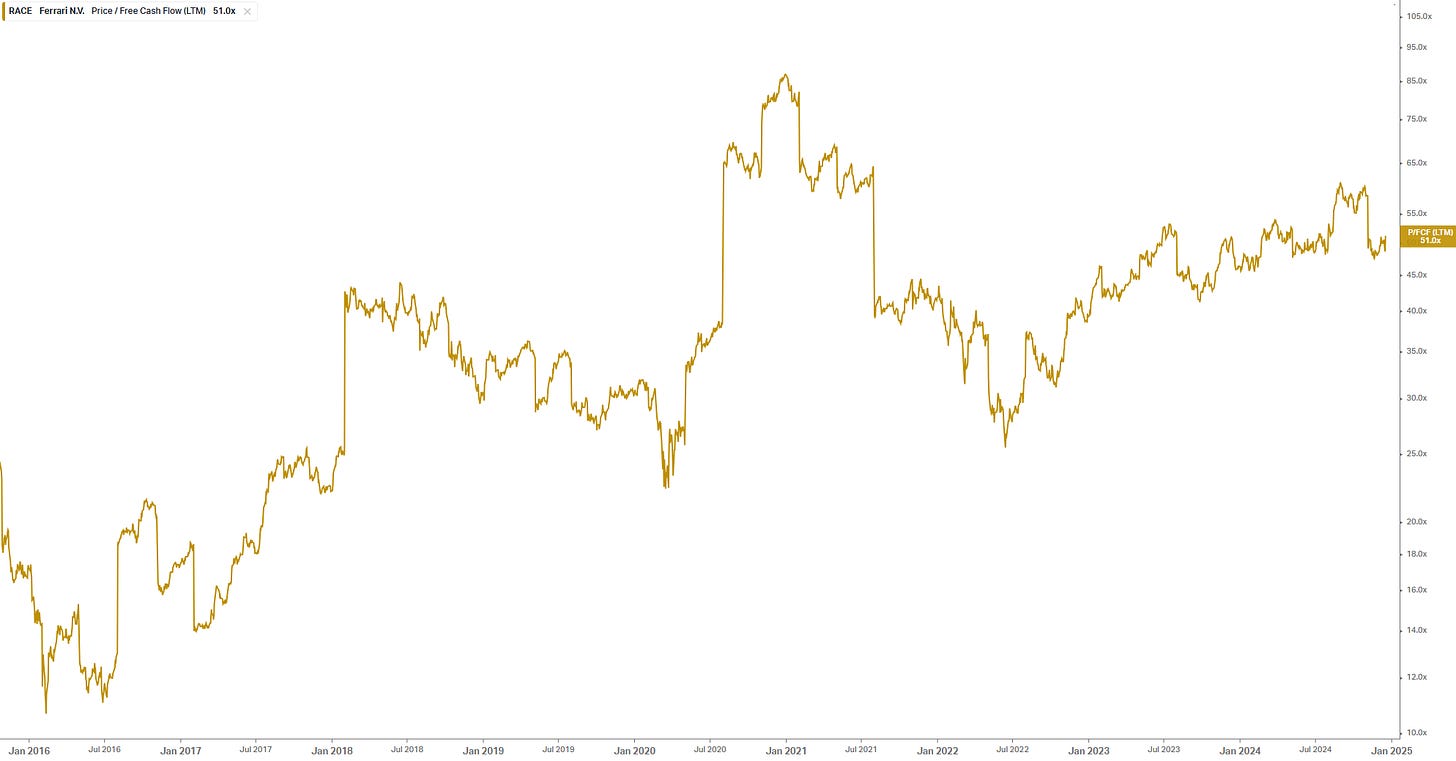

Looking at the historical multiples of the company, Ferrari is trading at a much richer valuation that it has been in the past as the market has been realizing Ferrari’s market dominance as the true luxury sportscar brand in the market. A substantial amount of Ferrari’s 10-year performance has been thanks to the “twin engines” of both business growth and multiple expansion:

This means that Ferrari’s 10-year return (slightly less than that since it IPO’d in 2015 so 9 years) is driven by:

Free cash flow per share = 13.8% of the total return

Multiple expansion = 12.4% of the total return

So it’s clearly benefitted from the “twin engines” in the return, with the multiple almost on par with FCF/share growth as part of its total returns. This is what ultimately transforms companies into compounding machines.

It’s currently trading at what looks to be a rich multiple at around 51x FCF multiple (as of this time writing) and the market is clearly pricing in a lot of expectations into the stock. While Ferrari may look optically expensive at a glance, but what many investors overlook is that luxury companies like Ferrari have a much higher terminal value than the average company and should therefore be valued at a higher multiple.

They should trade at a much higher multiple because from what we learned, Ferrari is an outstanding quality company. The earnings or FCF multiple does not tell you the:

Return on capital invested in the business (Ferrari’s is much higher than the average S&P500 business)

How much of the earnings produced is converted to free cash flow

What the reinvestment rate is

The competitive landscape of the industry

How sustainable or resilient the business is in the face of economic cycles

And so much more. That is why it is important to answer these questions first before scaring away because of the P/E or P/FCF multiple. Investors have missed great companies who have vastly outperformed the S&P500 simply because of the multiple, but in reality great companies really do deserve that multiple.

Had investors not have dived deeply into the multiple in January 2021 when the trailing twelve months’ FCF multiple was at its highest ever since inception, they would have missed out on a juicy +105% gain since (this is just an example):

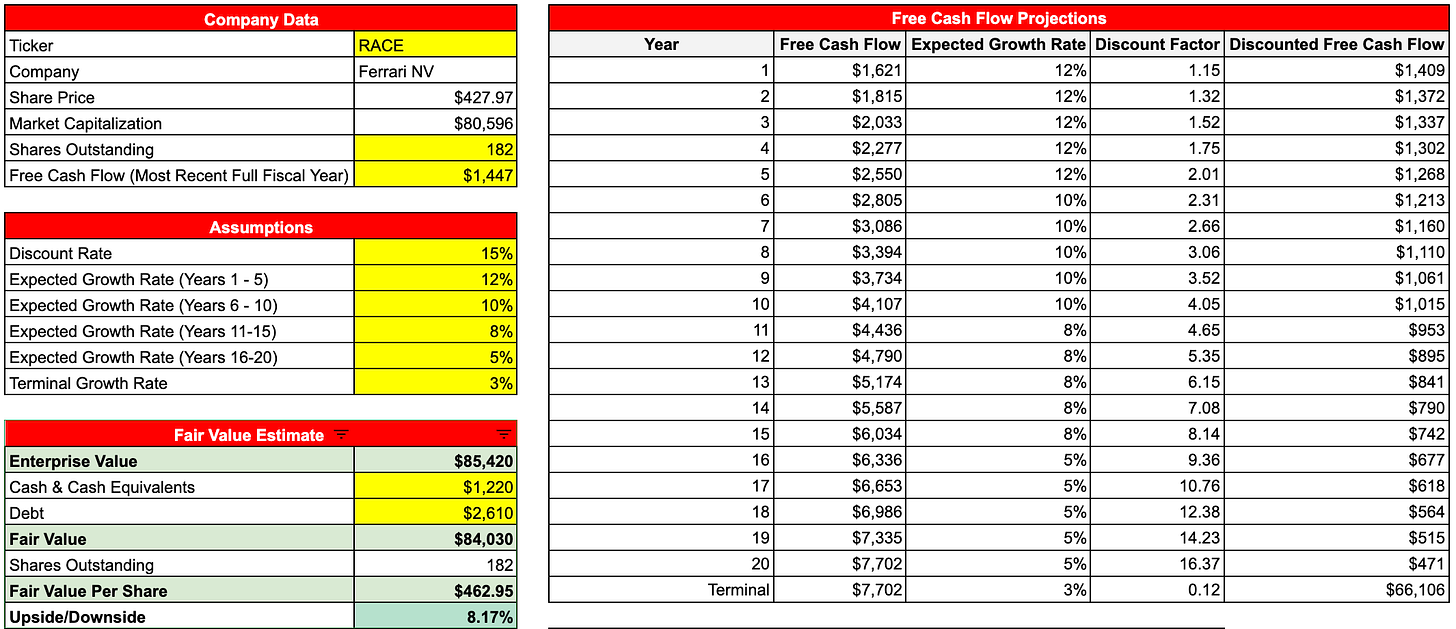

We computed what is a ‘reasonable price’ to pay for Ferrari through the following DCF model. Our assumptions are:

20-year forecast

Terminal growth rate at 3% — because the economy grows at 2-3% per year

Discount rate of 15% as our desired annualized return

12% CAGR from Years 1-5

10% CAGR from Years 6-10

8% CAGR from Years 11-15

5% CAGR from Years 16-20

This leaves us with a fair value of USD $463/share using the DCF model (around an 8% upside from current price levels). I am also not painting a conservative nor bullish estimate. Just my own estimates that I think will have the most certainty and accuracy to play out in the long run (what most investors call ‘base case’).

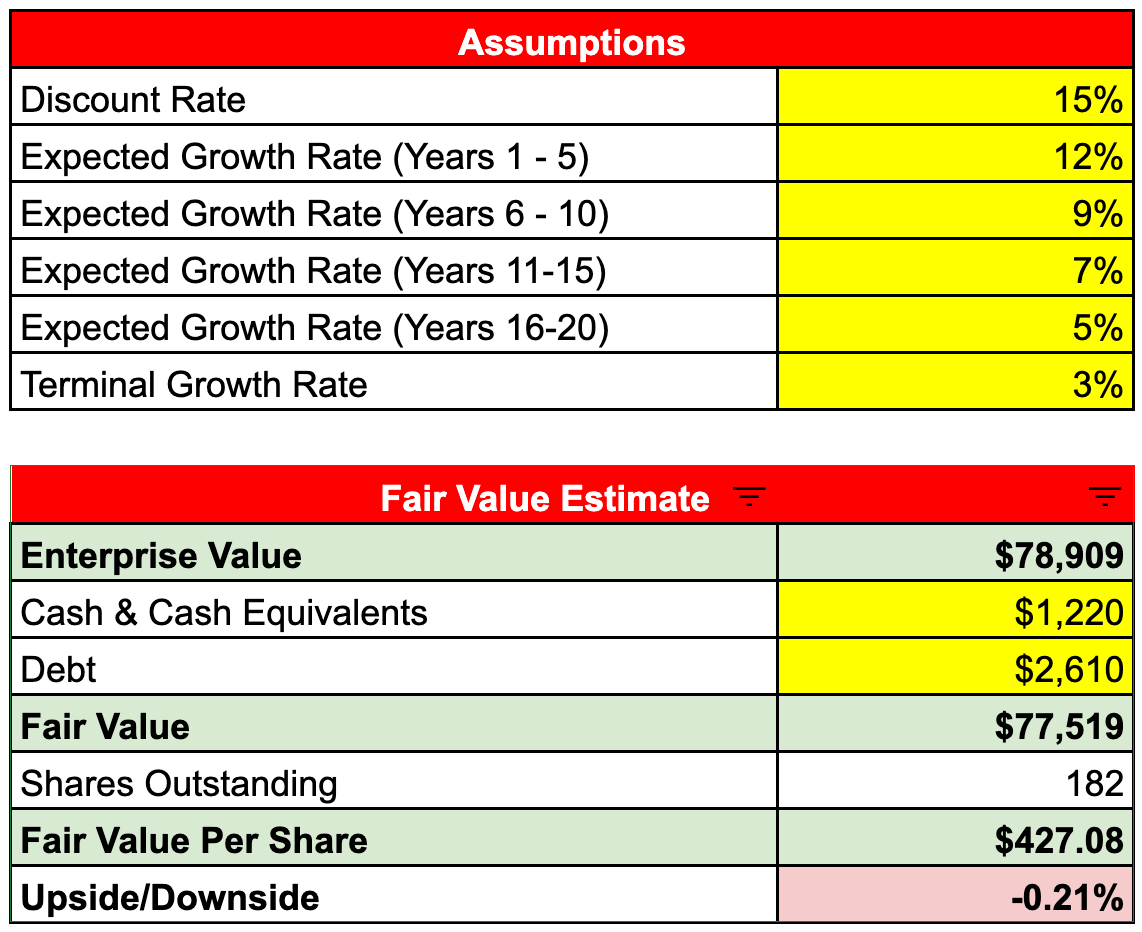

We can also use a Reverse DCF model (which might be my preferred method for valuation) to view what FCF growth is already baked into the stock price and whether those numbers are reasonable going forward. This method takes away the subjectivity involved forecasting the future FCF growth rate, something that is no easy task for an investor.

Therefore, the Reverse DCF tells us that to return an annualized return of 15%, Ferrari must grow its FCF by:

12% CAGR from Years 1-5

9% CAGR from Years 6-10

7% CAGR from Years 11-15

5% CAGR from Years 16-20

To simplify this even further, what this is saying is that Ferrari must grow its FCF per share by 8.2% per year for the next two decades to justify today’s current valuation. For reference, the company has grown its FCF per share by 13.8% over the past decade, so I think this growth is still reasonable going forward.

If the multiple contracts to a ‘more reasonable’ multiple towards the mean, at for example 35x, investors can expect a -1.86% CAGR headwind in future returns from the multiple assuming one is holding for the next 20 years. If an investor only aims to hold for the next 10 years, the multiple becomes a -3.69% CAGR headwind. As demonstrated, the multiple fades over time as you hold longer and as the business is a high-quality one. So I don’t focus too much on the multiple.

With already at an USD $80 billion market cap, some investors might argue that Ferrari has no room left to grow. But this is simply not the case. We have seen luxury companies like Hermes (the best luxury company, in my opinion) who have been successful in retaining the exclusive status of the brand while using innovative strategies to grow too. I am confident that management will continue to find ways around this dilemma of exclusivity and growth over the next decade and beyond.

So, given what your own margin of safety is, I actually think Ferrari is actually trading somewhere around fair value or slightly overvalued at this price point. If you have a higher margin of safety, consider price levels below $380 for a full position. This is, of course, very subjective depending on your holding period. If you seek to own Ferrari for a time period below 5 or even 10 years, you may need a higher margin of safety to justify today’s valuation.

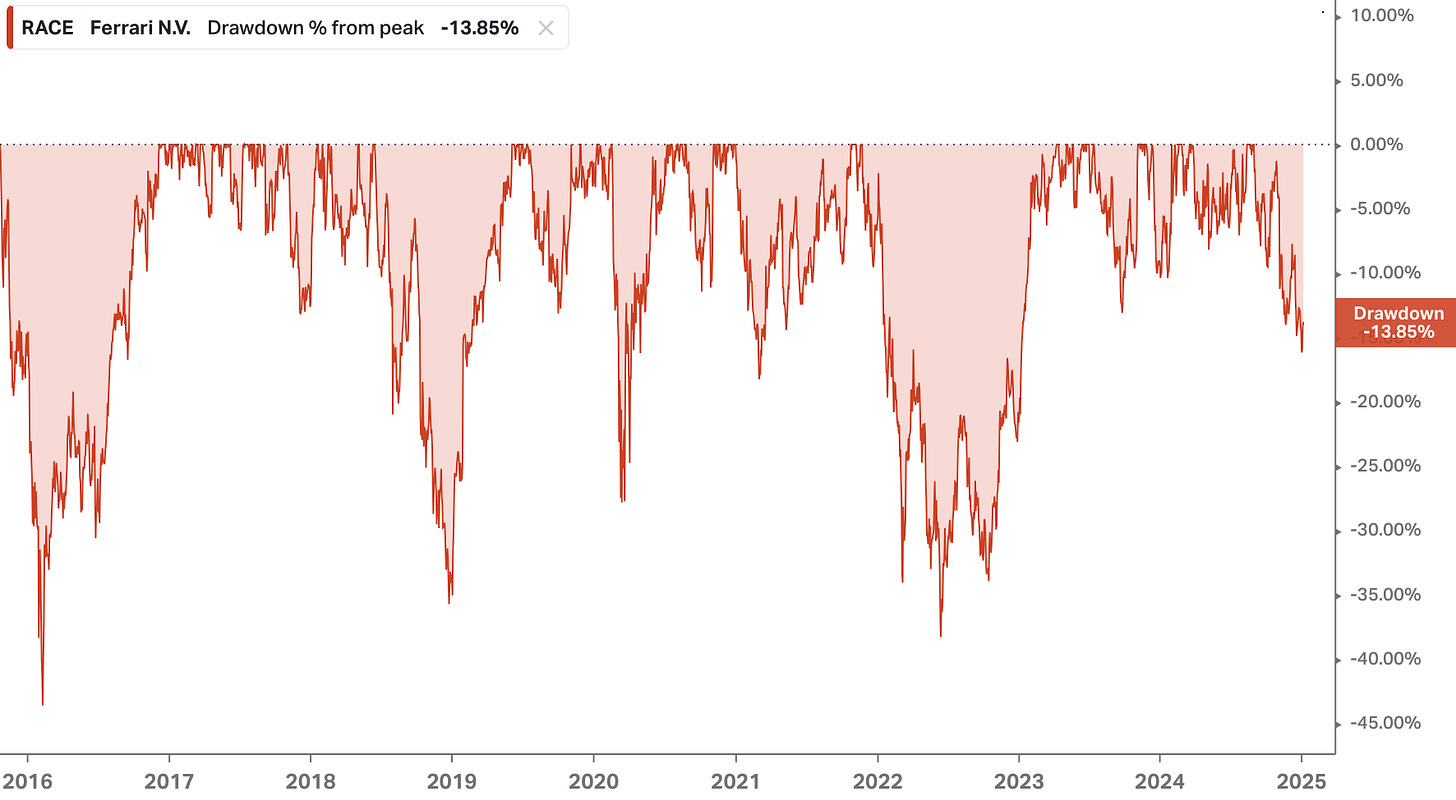

We are currently seeing a 14% drawdown from its peak. This could be a dip-buying opportunity:

But knowing that the entire luxury market is slowing down, the stock could be in it for a longer period. While I do not focus too much on the macroeconomics, Bain & Company expects a 2% decline in personal luxury goods sales this year, which would mark the first decline since the Great Financial Crisis (besides the pandemic).

“This is the first time the personal luxury goods industry has declined since the 2008-2009 crisis, with the exception of the pandemic.”

— Bain & Company

As always, if you are holding Ferrari currently, I suggest to keep on holding! (This is not financial advice!) This is a wonderful business that has a higher terminal value than most companies and therefore should be left alone in one’s portfolio to experience the wonderful joys of compounding.

Remember, buying a great company at the wrong price can turn out to be a horrible investment. So I suggest sitting on your butt with extreme patience.

For the case of good businesses, if you don’t like the valuation here, you can always buy a bit now and buy more later when the valuation drops. This way, you can ride the wave of a quality business, capturing its upside regardless of short-term market fluctuations if you are holding for the long-term anyway.

In my opinion, however, there are currently better opportunities out there that are still of high-quality trading at better valuations even when looking out 10+ years from now. But this is definitely a high-quality company and a compounding machine to add to one’s portfolio.

I’m going to continue to write more of these deep dives for quality companies (hopefully more frequently!). I’ll see you next time in my next deep dive.

Until then, fellow investor!

_________________________________________________________________________

Thanks for reading. I put a lot of hours into completing this deep dive for free, so I would appreciate it if you could subscribe to this Substack and follow me on X/Twitter @Pngfund for more of my insights like this. Cheers!

What a blog! Very well written.

Loved every bit of it.

This what I needed to read before making an investment decision in $RACE.

Look forward to more such gold bombs!

I would maybe point out an issue that I see in your valuation model. Shouldn't be a terminal value discounted to the present day?